Adani Group is one of the leading business conglomerates and the largest integrated player in infrastructure and energy space in India.

Over three decades, the group has emerged as a global player with business operations spread across key sectors like energy, resources, logistics, and agro, amongst others. Since inception, the group has focused on serving the diverse needs of people, deliver strong value propositions and contribute to nation-building.

The $ 13 billion Adani Group is one of India’s largest integrated infrastructure conglomerates with interests in the following sector.

- Resources (coal mining and trading),

- Logistics (ports, logistics, shipping and rail),

- Energy (renewable and thermal power generation, transmission and distribution), and

- Agro (commodities, edible oil, food products, cold storage and grain silos),

- Real Estate,

- Public Transport Infrastructure,

- Consumer Finance,

- Solar Manufacturing and

- Defense.

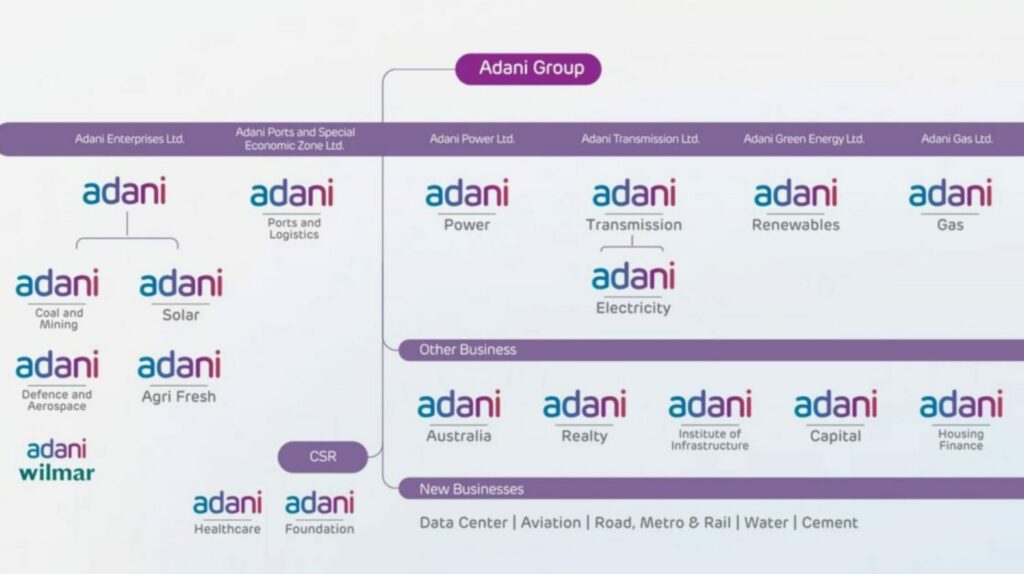

The following Chart shows the Adani Group Subsidiaries

Adani Group Subsidiaries

The following are Companies under Adani Group Subsidiaries

| No | Company Name |

| 1 | Adani Enterprises Limited |

| 2 | Adani Ports & Special Economic Zone Ltd |

| 3 | Adani Power Ltd |

| 4 | Adani Transmission Ltd |

| 5 | Adani Green Energy Ltd |

| 6 | Adani Gas Limited |

Adani Enterprises Limited

- Sales₹ 1,21,572 Cr.

- Operating profit₹ 9,610 Cr.

- Net profit₹ 2,630 Cr.

- Sales last year₹ 1,36,978 Cr.

Adani Enterprises is an incubator focusing on establishing new businesses in the infrastructure and energy sector. It has done this consistently since 1994 when it was first established and listed. Businesses like APSEZ, Adani Power, Adani Transmissions and other businesses were demerged from Adani Enterprises and/or independently listed on the stock exchanges. Read More About Adani Enterprises.

- Total Assets₹ 1,41,278 Cr.

- Reserves₹ 32,937 Cr.

- Debt₹ 53,200 Cr.

- Debt to equity1.61

- Dividend yield0.05 %

- Face value₹ 1.00

- ROE 5Yr6.27 %

- ROCE9.49 %

- ROCE 3Yr8.15 %

- Return on equity9.63 %

- Promoter holding67.6 %

In the last two years, consistent with the same model The have demerged Adani Green Energy Limited and Adani Gas Limited from Adani Enterprises which were respectively listed in June 2018 and November 2018. Read More About Adani Enterprises.

Adani Ports & Special Economic Zone Ltd

Adani Ports and Special Economic Zone Limited (APSEZ) is the largest commercial ports operator in India accounting for nearly one-fourth of the cargo movement in the country. It is the Main Company in Adani Group Subsidiaries.

- Sales₹ 22,041 Cr.

- Operating profit₹ 12,547 Cr.

- Net profit₹ 6,335 Cr.

- Sales last year₹ 20,852 Cr.

- EBIDT last year₹ 12,488 Cr.

Its presence across 10 domestic ports in six maritime states of Gujarat, Goa, Kerala, Andhra Pradesh, Tamil Nadu, and Odisha presents the most widespread national footprint with deepened hinterland connectivity. Read more about Adani Ports and Special Economic Zone Ltd

- Total Assets₹ 1,12,705 Cr.

- Reserves₹ 44,985 Cr.

- Debt₹ 53,136 Cr.

- Debt to equity1.16

- Dividend yield0.60 %

- Face value₹ 2.00

- ROE 5Yr15.6 %

- ROCE9.53 %

- ROCE 3Yr11.4 %

- Return on equity14.3 %

- Promoter holding62.9 %

The port facilities are equipped with the latest cargo-handling infrastructure which is not only best-in-class but also capable of handling the largest vessels calling at Indian shores. The Company ports are equipped to handle diverse cargos, from dry cargo, liquid cargo, crude to containers.

Adani Power Ltd

- Sales₹ 36,056 Cr.

- Operating profit₹ 7,839 Cr.

- Net profit₹ 14,706 Cr.

- Sales last year₹ 38,773 Cr.

- EBIDT last year₹ 14,350 Cr.

Adani Power Limited (APL is the largest private thermal power producer in India. The Company has a power generation capacity of 12,450 MW comprising thermal power plants in Gujarat, Maharashtra, Karnataka, Rajasthan, and Chhattisgarh and a 40 MW solar power project in Gujarat.

- Total Assets₹ 85,821 Cr.

- Reserves₹ 25,772 Cr.

- Debt₹ 42,181 Cr.

- Debt to equity1.40

- Dividend yield0.00 %

- Face value₹ 10.0

- ROE 5Yr24.0 %

- ROCE15.8 %

- ROCE 3Yr14.5 %

- Return on equity44.0 %

- Promoter holding75.0 %

Adani is the world’s first company to set up a coal-based Supercritical thermal power project registered under the Clean Development Mechanism (CDM) of the Kyoto protocol. Despite being a new entrant to power generation in 2006, The company capitalised on the project management skills of the Adani Group to set up our first power plant at Mundra successfully and efficiently.

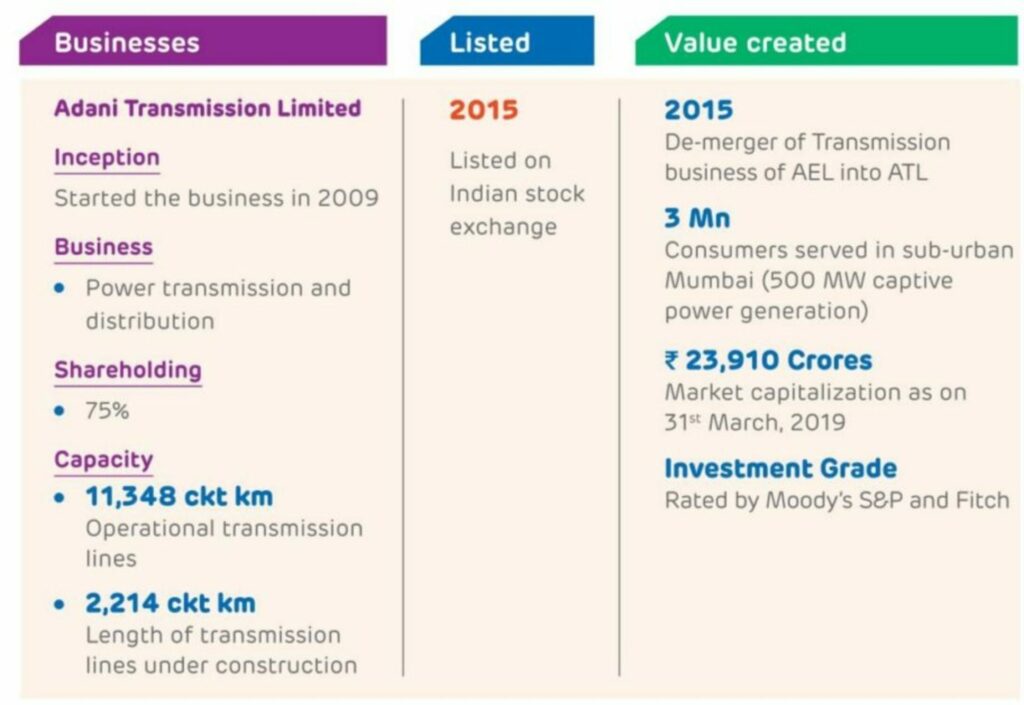

Adani Transmission Ltd

The Adani Group’s journey in the transmission sector started in 2006, well before Adani Transmission Limited (ATL) was formally established.

In 2018, ATL forayed into the distribution space with the acquisition of Reliance Infrastructure’s Power Generation, Transmission & Distribution Business in Mumbai. Today, Adani Electricity Mumbai Limited (AEML) caters to electricity needs of over 3 million customers in Mumbai suburbs and Mira-Bhayender Municipal Corporation in Thane district with a distribution network spanning over 400 sq. km.

Today, ATL is the largest private transmission company and operates more than 11,000 ckt km of transmission lines and around 18,000 MVA of power transformation capacity. ATL has further set an ambitious target to set up 20,000 circuit km of transmission lines by 2022 by leveraging both organic and inorganic growth opportunities.

Adani Green Energy Ltd

- Sales₹ 8,333 Cr.

- Operating profit₹ 6,064 Cr.

- Net profit₹ 1,082 Cr.

- Sales last year₹ 7,792 Cr.

- EBIDT last year₹ 5,870 Cr.

Adani Green Energy Limited (AGEL) is one of the largest renewable companies in India, with a current project portfolio of 5,290 MW. The Company develops, builds, owns, operates and maintains utility-scale grid-connected solar and wind farm projects. The electricity generated is supplied to central and state government entities and government-backed corporations.

- Total Assets₹ 66,909 Cr.

- Reserves₹ 5,720 Cr.

- Debt₹ 54,223 Cr.

- Debt to equity7.42

- Dividend yield0.00 %

- Face value₹ 10.0

- ROE 5Yr10.5 %

- ROCE7.81 %

- ROCE 3Yr8.56 %

- Return on equity22.8 %

- Promoter holding56.3 %

On the back of long-term Power Purchase Agreements (PPAs) of 25 years with central and state government entities, AGEL has leveraged its capabilities and expanded its presence across 11 Indian states. The Company deploys the latest technologies in its projects. With a portfolio of 46 operational projects and 18 projects under construction, AGEL is driving India on its renewable energy journey.

Adani Gas Limited

- Sales₹ 4,392 Cr.

- Operating profit₹ 893 Cr.

- Net profit₹ 558 Cr.

- Sales last year₹ 4,378 Cr.

- EBIDT last year₹ 924 Cr.

Adani Gas is developing City Gas Distribution (CGD) networks to supply the Piped Natural Gas (PNG) to the Industrial, Commercial, Domestic (residential) and Compressed Natural Gas (CNG) to the transport sector. Natural Gas is a convenient, reliable and environment-friendly fuel that allows consumers to enjoy a high level of safety, convenience, and economic efficiency.

- Total Assets₹ 5,645 Cr.

- Reserves₹ 2,831 Cr.

- Debt₹ 1,422 Cr.

- Debt to equity0.48

- Dividend yield0.04 %

- Face value₹ 1.00

- ROE 5Yr24.9 %

- ROCE20.7 %

- ROCE 3Yr25.7 %

- Return on equity20.4 %

- Promoter holding74.8 %

The company has already set up city gas distribution networks in Ahmedabad and Vadodara in Gujarat, Faridabad in Haryana and Khurja in Uttar Pradesh. In addition, the development of Allahabad, Chandigarh, Ernakulam, Panipat, Daman, Dharwad, and Udhamsingh Nagar gas distribution is awarded to a consortium of Adani Gas Ltd and Indian Oil Corporation Ltd.

Over three decades, the Adani group has emerged as a global player with business operations spread across key sectors like energy, resources, logistics, and agro, amongst others.

Mr. Gautam Adani is the CEO of adani Group and has more than 35 years of business experience. Under his leadership, Adani Group has emerged as a global integrated infrastructure player with interest across Resources, Logistics and Energy verticals.

![Indiabulls Group Stocks [Companies] Owner](https://indiancompanies.in/wp-content/uploads/2021/01/Indiabulls-Group-Stocks-Companies-Owner.png)

I need to establish a business connection with a company in your group manufacturing Solar Panels. I have a registered manufacturing concern under the name of Cosmo Engineering Works situated in Sri Lanka 9 km from Colombo in close proximity to the Express Highway to Katunayake International Airport. I think of importing Solar Panels from India to supply them to the local market. Power outages are frequent in Sri Lanka. Solar power is the only sustainable solution and a thriving market for solar panels is guaranteed. Help me to start somewhere. An early response will be greatly appreciated.