The Nifty Financial Services Index is designed to reflect the behavior and performance of the Indian financial market which includes

- Banks,

- Financial institutions,

- Housing finance,

- Insurance companies and

- Other Financial services companies.

All Companies in this index is form part of the Finance Sector.

Nifty Financial Services Index

The Index comprises of 20 stocks that are listed on the National Stock Exchange (NSE). NIFTY Financial Services Index is computed using a free-float market capitalization method, wherein the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value. Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

- Base Date: January 01, 2004

- Base Value: 1000

- Launch Date: September 07, 2011

- No of Constituents: 20

Top Company Weightage in Financial Services Index

Here is the list of Top Companies in financial services index with high Weightage arranged in Order

- HDFC Bank Ltd. 24.77 % Stock Weightage

- Housing Development Finance Corporation 18.74 % Stock Weightage

- ICICI Bank Ltd. 15.69 % Stock Weightage

- Kotak Mahindra Bank Ltd. 10.14 % Stock Weightage

- Axis Bank Ltd. 7.56 % Stock Weightage

- State Bank of India 5.77 % Stock Weightage

- Bajaj Finance Ltd. 4.93 % Stock Weightage

- Bajaj Finserv Ltd. 2.56 % Stock Weightage

- HDFC Life Insurance Company Ltd. 1.65 % Stock Weightage

- SBI Life Insurance Company Ltd. 1.60 % Stock Weightage

Weightage of each stock in the index is be calculated based on its free-float market capitalization such that no single stock shall be more than 34% and weightage of the top 3 stocks cumulatively shall not be more than 63% at the time of rebalancing.

Fundamental PE (P/E) and PB (P/B) Ratio and Dividend Yield of Financial services index

- P/E: 35.37

- P/B: 4.56

- Dividend Yield: 0.48

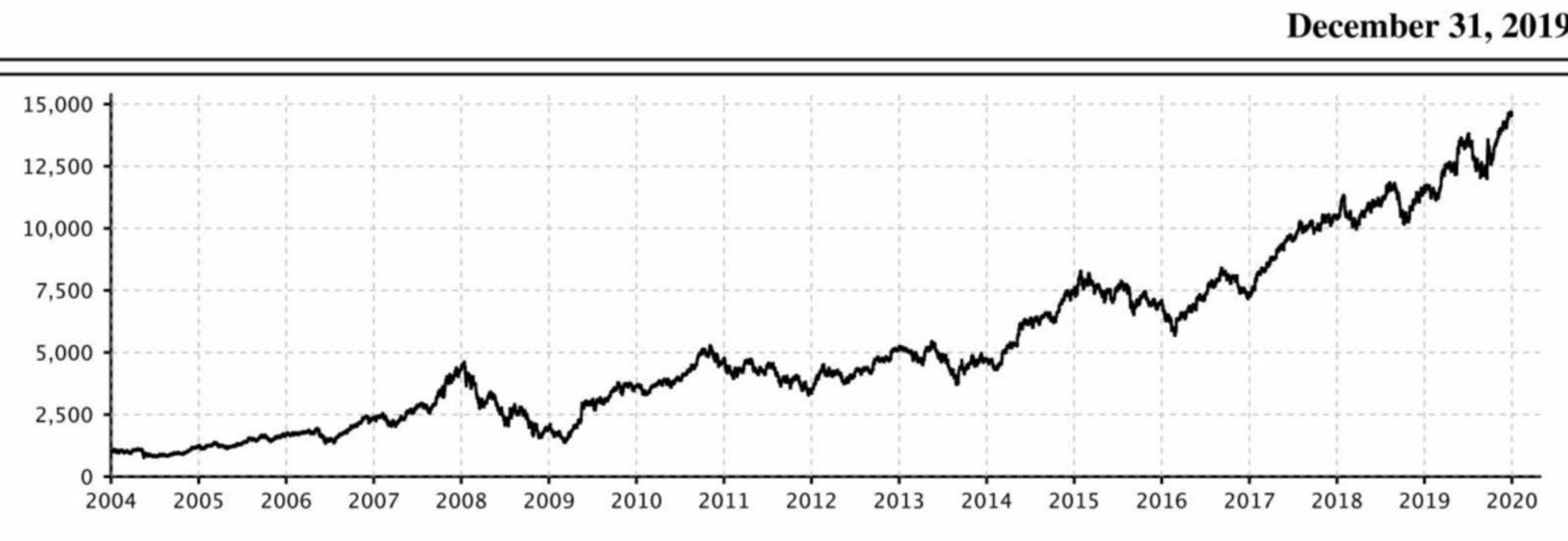

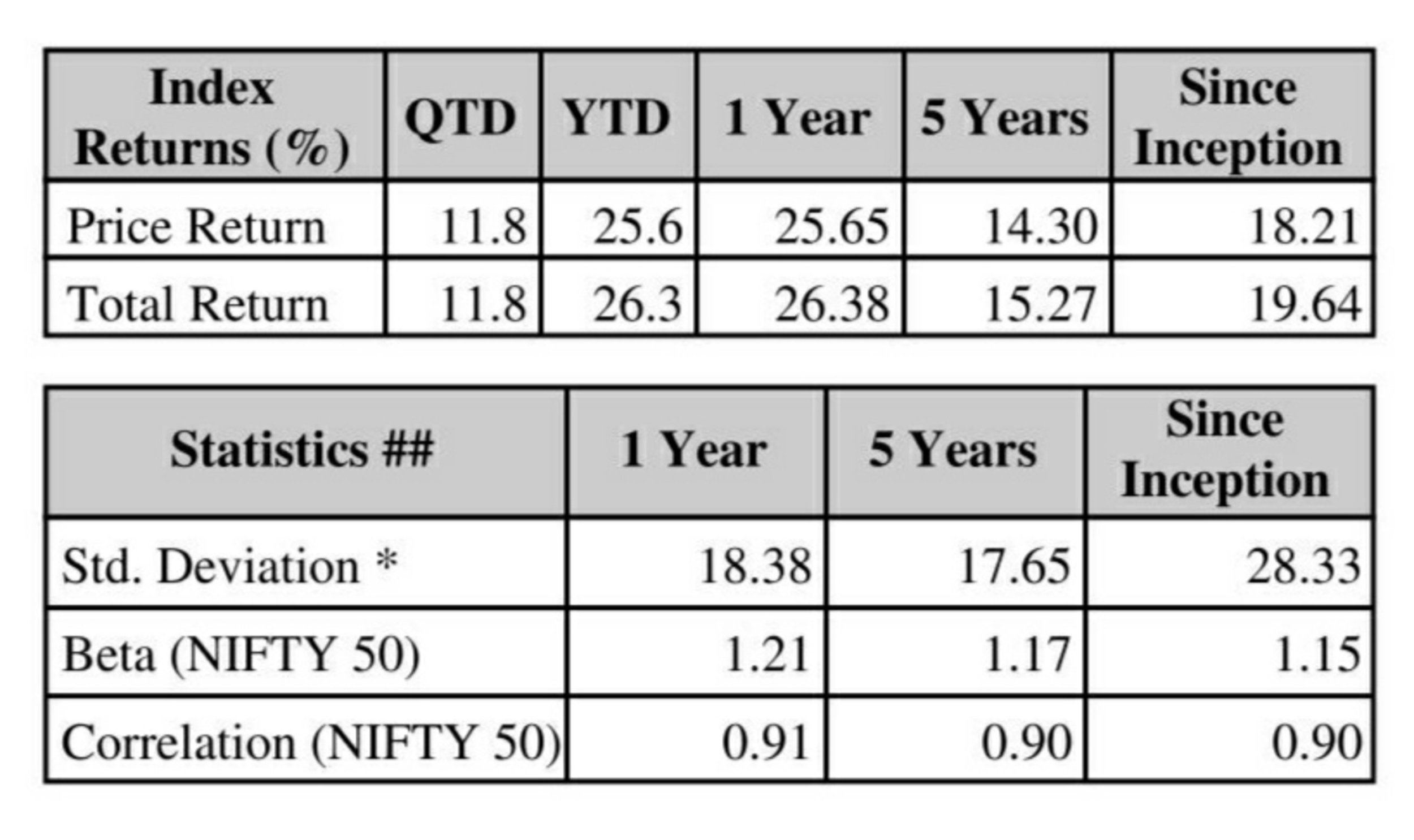

Return of Financial services index and historical data chart

Nifty Financial services index has given a total return of 19.64 % CAGR for the last sixteen years from the year 2004 to 2020

![Finance Company in India [List]](https://indiancompanies.in/wp-content/uploads/2020/07/Finance-Company-in-India-List.png)

Excellent blog post. I definitely appreciate this site. Keep it up!

Nice article!! I like it and thanks for sharing that wonderful information.Thank you