Small Industries Development Bank of India ( SIDBI ) as the Principal Financial Institution for Promotion, Financing and Development of the Micro, Small and Medium Enterprise (MSME). MSMEs are vital drivers of economic growth and essential to building healthy and prosperous communities.

Small Industries Development Bank of India [ SIDBI ] Being the apex financial institution of the sector, the Bank is strengthening its support to the sector in terms of financing, promotion, development and effective coordination among stakeholders, with an aim to create robust underlying ecosystem in which MSMEs operate.

Small Industries Development Bank of India SIDBI

Small Industries Development Bank of India ( SIDBI ) set up on 2nd April 1990 under an Act of Indian Parliament, acts as the Principal Financial Institution for Promotion, Financing and Development of the Micro, Small and Medium Enterprise (MSME) sector as well as for co-ordination of functions of institutions engaged in similar activities.

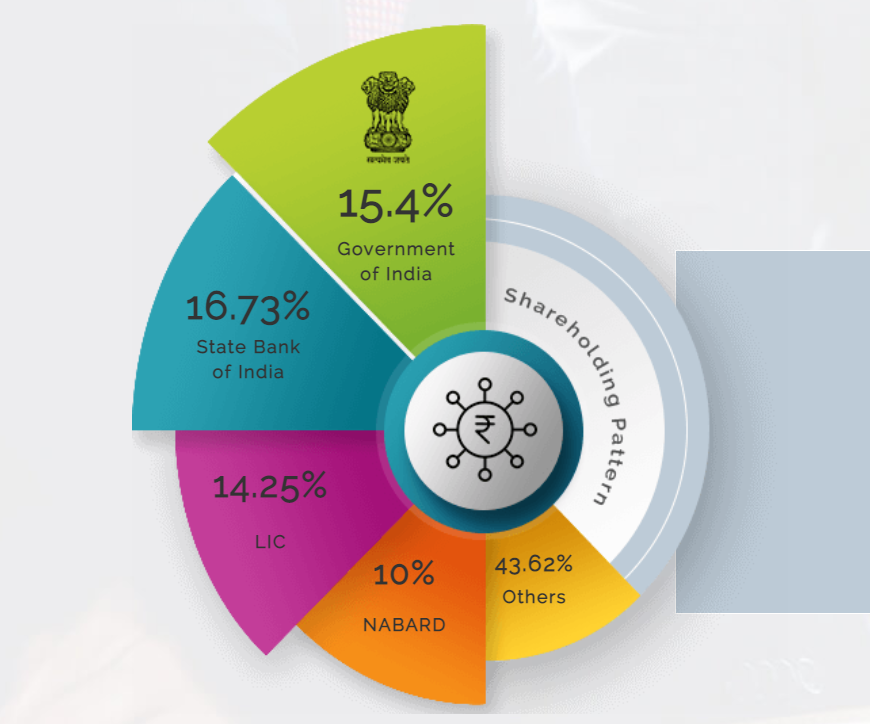

Most of The Shares of SIDBI are held by the Government of India and twenty-two other institutions / public sector banks / insurance companies owned or controlled by the Central Government.

• Total staff- 1,048

• Officers- 916 officers

• Women employees – 240 (23%)

- The Gross Non-Performing Assets ratio stood at 0.63% in FY 2020.

- Provision Coverage Ratio (PCR) was at 78% as of March 2020

- Net Interest Margin (NIM) is 14% during FY 2020

Asset Base registered Y-o-Y growth of 20.3% and reached a new peak of Rs 1,87,539 crore (1,55,861 crore in FY 2019) as of the end of FY 2020. Loans and Advances grew by 21.4%, and was Rs 1,65,422 crore as of the end of FY 2020.

The function of SIDBI Include Promotion, Financing and Development of the Micro, Small and Medium Enterprise (MSME).

SIDBI was set up on 2nd April 1990 under an Act of Indian Parliament, acts as the Principal Financial Institution for Promotion, Financing and Development of the Micro, Small and Medium Enterprise (MSME) sector.

Indirect Lending– based on multiplier effect/ larger reach in financing the MSME sector and is undertaken through Banks, SFBs, NBFCs, MFIs and New Age Fintechs.

Direct Lending– aims to fill the existing credit gaps in the MSME sector and is undertaken through demonstrative and innovative lending products, which can be further scaled up by credit delivery ecosystem.

Fund of Funds– boosts entrepreneurship culture by supporting emerging startups through the Fund of Funds channel.

Promotion and Development– promoting entrepreneurship and handholding budding entrepreneurs for holistic development of MSME sector through credit-plus initiatives.

Facilitator– playing a facilitator through roles like Nodal Agency for the MSME oriented Schemes of the Government.

Micro Lending Development

Launched in April 2000 under collaboration with Department for International Development (DFID), UK to bring in best microfinance practices in India. Collaboration was made with International Fund for Agricultural Development (IFAD), Rome in April-2002 for on lending support to MFIs.

- Developed the capacity of 100+ MFIs

- Cumulative Sanctions: ₹19029 cr

- Cumulative Disbursements: ₹17327 cr

- Impacted more than 38.5 million beneficiaries

- SC/ST/ backward classes accounting for approx. 73% of the total beneficiaries.

- Women proportion was 96-98% among the beneficiaries.

- Brought out changes in the livelihood pattern by giving impetus to enterprise activity

- Out of10 entities having received the SFB license from RBI, eight were partner MFIs of SIDBI

- Need based interventions to facilitate smooth transition from MFI to SFBs.

- Equity investment and resource support with provisions for conversion

Mission and Vision of SIDBI

MISSION: To facilitate and strengthen credit flow to MSMEs and address both financial and developmental gaps in the MSME eco-system

VISION: To emerge as a single window for meeting the financial and developmental needs of the MSME sector to make it strong, vibrant and globally competitive, to position SIDBI Brand as the preferred and customer – friendly institution and for enhancement of share – holder wealth and highest corporate values through modern technology platform.

SIDBI Chairman and Managing Director

Shri Sivasubramanian Ramann, belongs to 1991 batch of Indian Audit & Accounts Service (IA&AS). He joined as Chairman & Managing Director, Small Industries Development Bank of India (SIDBI) from 19th April 2021. Before joining SIDBI, he was MD & CEO of National E-Governance Services Limited (NeSL) from December 2016.

Prior to joining NeSL, Shri Ramann was the Principal Accountant General (Audit), Jharkhand, Ranchi during 2015-2016. He worked with SEBI as CGM and later Executive Director between 2007 & 2013.

He held various positions in the offices under the C&AG of India in various States and also worked as Executive Secretary to the C&AG of India. He worked as First Secretary, at Indian High Commission, London for auditing the accounts of various Indian Embassies in Europe.

He is BA (Hons) Economics from St Stephens College and MBA from FMS, Delhi University. He has done M. Sc. in Regulations from London School of Economics and Certified Internal Auditor from IIA Florida. He completed LLB from Mumbai University and Post Graduate Diploma in Securities Law.

Small industries development bank of India Subsidiaries

The Following are the Subsidiaries of Small Industries Development Bank of India [ SIDBI ].

- SIDBI Venture Capital Limited (SVCL) (1999)

- Micro Units Development & Refinance Agency (MUDRA) (2015)

- Credit Guarantee Fund Trust for MSEs (CGTMSE) branded as UDAAN (2000)

- Receivables Exchange of India Limited (RXIL) (2016)

- Acuité Ratings & Research Limited (Acuité) (2005)

- India SME Asset Reconstruction Company Ltd (ISARC)

- India SME Technology Services Limited (ISTSL) (2005)

- ONLINE PSB LOANS Ltd PSBLoansin59minutes

These are the list of Small industries development bank of India Subsidiaries