Swaraj Engines Limited is a prominent player in the Indian manufacturing sector, specializing in the production of diesel engines, components, and spare parts. With a robust operational framework, a strong financial track record, and a commitment to excellence, the company has established itself as a key supplier in the automotive and agricultural machinery industries. This detailed post explores the company’s profile, business segments, products, history, brands, geographical presence, financial performance, subsidiaries, physical properties, leadership, shareholding, and future plans.

Company Profile

Swaraj Engines Limited is a public limited company incorporated under the Companies Act, with its registered office at Phase IV, Industrial Area, S.A.S. Nagar (Mohali), Punjab-160055, India. The company’s Corporate Identification Number (CIN) is L50210PB1985PLC006473. It operates a manufacturing facility at Plot No. 2, Industrial Phase IX, S.A.S. Nagar (Mohali), Punjab-160062. Swaraj Engines is engaged in the business of manufacturing diesel engines, diesel engine components, and spare parts, primarily catering to the agricultural and automotive sectors. The company is listed on the BSE Limited and the National Stock Exchange of India Limited, with its shares actively traded.

The company’s leadership includes Mahesh Gupta as Chief Financial Officer and Rajesh K. Kapila as Company Secretary. Its banking relationships are with HDFC Bank Limited and Axis Bank Limited, and its registrar and transfer agent is M/s MCS Share Transfer Agent Limited, based in New Delhi. Swaraj Engines is audited by M/s B K Khare & Co., Chartered Accountants, ensuring compliance with financial and regulatory standards. The company’s commitment to corporate governance is evident through its adherence to the Securities and Exchange Board of India (SEBI) regulations and the Companies Act, 2013.

Swaraj Engines has demonstrated consistent growth, as evidenced by its key performance indicators over the last decade, with a focus on operational efficiency, profitability, and shareholder value. The company’s website, www.swarajenterprise.com, serves as a platform for stakeholders to access information about its operations, financials, and governance practices.

Business Segments

Swaraj Engines operates as a single-segment business, focusing exclusively on the manufacture and sale of diesel engines, diesel engine components, and spare parts. As per the Indian Accounting Standards (Ind AS) 108 on “Operating Segments,” the company’s activities are governed by a unified set of risks, returns, and internal business reporting systems, leading to their classification as a single segment. This strategic focus allows Swaraj Engines to streamline its operations and optimize resource allocation.

Comprehensive Details of Business Segment

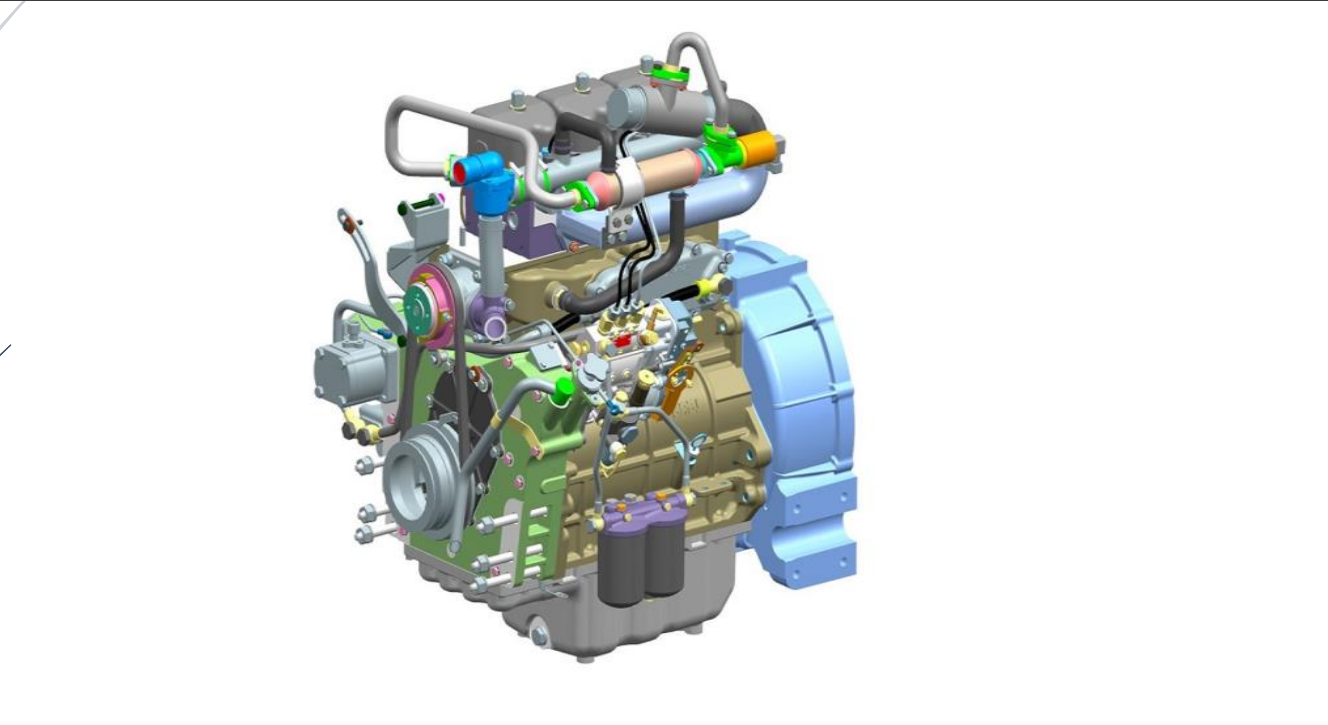

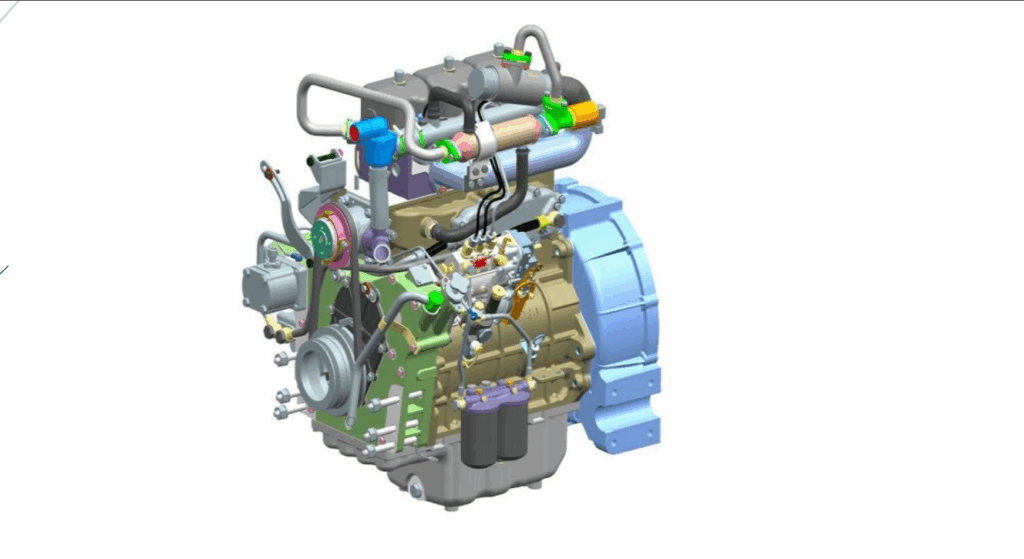

- Segment Description: The company’s core business revolves around the production of diesel engines and related components, primarily for use in tractors and other agricultural machinery. These engines are designed to meet the needs of the agricultural sector, ensuring reliability and efficiency.

- Revenue Breakup (FY 2024-25):

- Engines: Rs. 164,081.55 lakhs (97.53% of total revenue)

- Spares: Rs. 3,310.04 lakhs (1.97% of total revenue)

- Other Operating Revenue (Scrap & Others): Rs. 797.64 lakhs (0.47% of total revenue)

- Total Revenue from Operations: Rs. 168,189.23 lakhs

The revenue distribution highlights the company’s heavy reliance on engine sales, which form the backbone of its operations. Spare parts and other operating revenues, such as scrap sales, contribute marginally but are integral to the company’s ecosystem.

Products and Services

Swaraj Engines specializes in the production and sale of diesel engines, engine components, and spare parts. The company’s product portfolio is tailored to meet the demands of the agricultural machinery sector, particularly for tractor manufacturing.

List of Products and Services

- Diesel Engines:

- Description: High-performance diesel engines designed for agricultural tractors, known for durability and fuel efficiency.

- Production (FY 2024-25): 168,225 units

- Despatches (FY 2024-25): 168,820 units

- Revenue (FY 2024-25): Rs. 164,081.55 lakhs (97.53% of total revenue)

- Spare Parts:

- Description: Components and spares for diesel engines, supporting maintenance and repair services.

- Revenue (FY 2024-25): Rs. 3,310.04 lakhs (1.97% of total revenue)

- Other Operating Revenue (Scrap & Others):

- Description: Revenue from the sale of scrap materials and other ancillary activities.

- Revenue (FY 2024-25): Rs. 797.64 lakhs (0.47% of total revenue)

Comprehensive Details

- Diesel Engines: The engines are engineered for high performance and reliability, catering primarily to the tractor manufacturing industry. The significant increase in production and despatches from 138,807 and 138,761 units in FY 2024 to 168,225 and 168,820 units in FY 2025, respectively, reflects growing demand and operational scalability.

- Spare Parts: These include a range of components essential for the maintenance and longevity of the engines. The marginal decline in spare parts revenue from Rs. 3,320.67 lakhs in FY 2024 to Rs. 3,310.04 lakhs in FY 2025 indicates stable aftermarket demand.

- Other Operating Revenue: This includes income from scrap sales and other minor activities, contributing a small but consistent portion to the revenue stream.

Company History

Swaraj Engines Limited was incorporated in 1985, with its Corporate Identification Number (CIN) L50210PB1985PLC006473, marking its establishment as a public limited company under the Companies Act. Based in Mohali, Punjab, the company has grown into a leading manufacturer of diesel engines, primarily serving the agricultural machinery sector. Since its inception, Swaraj Engines has focused on delivering high-quality engines and components, establishing a strong market presence through consistent performance and strategic partnerships.

The company transitioned to Indian Accounting Standards (Ind AS) from April 1, 2016, aligning its financial reporting with global standards. Over the years, it has scaled its operations, as evidenced by the growth in engine production from 64,088 units in FY 2016 to 168,820 units dispatched in FY 2025. This growth trajectory reflects the company’s ability to adapt to market demands and enhance its manufacturing capabilities.

Swaraj Engines has maintained a strong financial performance, with net operating revenue increasing from Rs. 525.91 crores in FY 2016 to Rs. 1,681.89 crores in FY 2025. The company has consistently paid dividends, with a proposed dividend of Rs. 104.50 per equity share for FY 2024-25, underscoring its commitment to shareholder value. Its market capitalization has also seen significant growth, rising from Rs. 1,063.88 crores in FY 2016 to Rs. 4,736.84 crores in FY 2025.

The company’s adherence to corporate governance, compliance with SEBI regulations, and robust internal controls have solidified its reputation as a reliable and transparent organization. Its focus on a single business segment has allowed it to maintain operational efficiency and capitalize on the growing demand for agricultural machinery in India.

Brands

Swaraj Engines operates under its own brand identity, focusing on diesel engines and components. The document does not explicitly mention additional brand names or sub-brands under which the company markets its products. Therefore, the primary brand is Swaraj Engines, which is synonymous with quality and reliability in the agricultural machinery sector.

Comprehensive Details

- Brand Name: Swaraj Engines

- Description: The brand represents high-quality diesel engines and components designed for agricultural applications, particularly tractors. The brand is recognized for its durability, efficiency, and performance.

- Revenue Breakup (FY 2024-25):

- Engines (Swaraj Engines Brand): Rs. 164,081.55 lakhs (97.53% of total revenue)

- Spares (Swaraj Engines Brand): Rs. 3,310.04 lakhs (1.97% of total revenue)

- Other Operating Revenue: Rs. 797.64 lakhs (0.47% of total revenue)

The brand’s revenue is derived entirely from the company’s core operations, with no distinct sub-brands identified in the provided data.

Geographical Presence

Swaraj Engines operates primarily in India, with its manufacturing and operational facilities located in Mohali, Punjab. The company’s registered office and works are both situated in S.A.S. Nagar (Mohali), indicating a concentrated geographical presence. The document does not provide explicit details on international operations or revenue from specific regions, suggesting that the company’s primary market is domestic.

List and Comprehensive Details

- Location: Mohali, Punjab, India

- Registered Office: Phase IV, Industrial Area, S.A.S. Nagar (Mohali), Punjab-160055

- Works: Plot No. 2, Industrial Phase IX, S.A.S. Nagar (Mohali), Punjab-160062

- Revenue Breakup (FY 2024-25):

- Domestic (India): Rs. 168,189.23 lakhs (100% of total revenue)

- International: Not applicable (0% of total revenue)

Comprehensive Details

- Domestic Focus: The company’s operations are centered in India, with its manufacturing facility in Mohali serving as the hub for production and distribution. The revenue data indicates that all sales, including engines and spares, are generated within India.

- Market Reach: While the document does not specify regional revenue distribution within India, the company’s products are likely distributed nationwide, given its significant production volumes and market capitalization.

Financial Performance

Swaraj Engines has demonstrated strong financial performance, as detailed in the financial statements for FY 2024-25. Below are the consolidated Profit and Loss Statement, Balance Sheet, and Cash Flow Statement presented in tabular format.

Consolidated Profit and Loss Statement (FY 2024-25)

| Particulars | FY 2025 (Rs. in Lakhs) | FY 2024 (Rs. in Lakhs) |

|---|---|---|

| Net Operating Revenue | 168,189.23 | 141,923.93 |

| Other Income | 1,641.37 | 1,435.67 |

| Total Income | 169,830.60 | 143,359.60 |

| Expenses | ||

| Cost of Materials Consumed | 126,093.40 | 105,706.93 |

| Changes in Inventories | 755.29 | (295.25) |

| Employee Benefits Expense | 3,934.12 | 3,587.54 |

| Finance Costs | 32.64 | 24.97 |

| Depreciation and Amortization | 2,034.33 | 1,730.78 |

| Other Expenses | 6,970.45 | 5,808.98 |

| Total Expenses | 139,820.23 | 116,563.95 |

| Profit Before Exceptional Items & Tax | 22,304.60 | 18,496.60 |

| Exceptional Items | – | – |

| Profit Before Tax | 22,304.60 | 18,496.60 |

| Income Tax | 5,706.83 | 4,709.67 |

| Profit After Tax | 16,597.77 | 13,786.93 |

| Other Comprehensive Income (Net of Tax) | (18.56) | 5.13 |

| Total Comprehensive Income | 16,579.21 | 13,792.06 |

Balance Sheet (As at March 31, 2025)

| Particulars | FY 2025 (Rs. in Lakhs) | FY 2024 (Rs. in Lakhs) |

|---|---|---|

| Assets | ||

| Non-Current Assets | ||

| Property, Plant and Equipment | 6,572.33 | 5,539.45 |

| Capital Work-in-Progress | 148.62 | 188.76 |

| Intangible Assets | 22.34 | 35.67 |

| Financial Assets (Investments, Loans, Others) | 10,950.00 | 10,950.00 |

| Other Non-Current Assets | 1,150.00 | 1,150.00 |

| Total Non-Current Assets | 18,843.29 | 17,863.88 |

| Current Assets | ||

| Inventories | 1,105.17 | 1,970.30 |

| Financial Assets (Trade Receivables, Cash, etc.) | 15,350.27 | 10,151.98 |

| Other Current Assets | 6,461.46 | 6,708.19 |

| Total Current Assets | 22,916.90 | 18,830.47 |

| Total Assets | 41,760.19 | 36,694.35 |

| Equity and Liabilities | ||

| Equity | ||

| Equity Share Capital | 1,214.68 | 1,214.66 |

| Other Equity | 40,706.83 | 35,641.93 |

| Total Equity | 41,921.51 | 36,856.59 |

| Liabilities | ||

| Non-Current Liabilities | 318.25 | 283.72 |

| Current Liabilities | 7,520.43 | 6,554.04 |

| Total Liabilities | 7,838.68 | 6,837.76 |

| Total Equity and Liabilities | 41,760.19 | 36,694.35 |

Cash Flow Statement (FY 2024-25)

| Particulars | FY 2025 (Rs. in Lakhs) | FY 2024 (Rs. in Lakhs) |

|---|---|---|

| A. Cash Flow from Operating Activities | ||

| Profit Before Exceptional Items and Tax | 22,304.60 | 18,496.60 |

| Adjustments for: | ||

| Depreciation and Amortization | 2,034.33 | 1,730.78 |

| Employee Stock Compensation | 24.19 | 18.54 |

| Interest (Received)/Paid (Net) | (1,479.82) | (1,287.05) |

| (Profit)/Loss on Mutual Fund Investment | (191.50) | (203.70) |

| (Profit)/Loss on Disposal of PPE | 85.07 | 99.16 |

| Net Gain on Financial Assets at FVTPL | (4.03) | (2.65) |

| Operating Profit Before Working Capital Changes | 22,772.84 | 18,851.68 |

| Movements in Working Capital | ||

| (Increase)/Decrease in Receivables | (5,198.29) | 943.64 |

| (Increase) in Inventories | (755.29) | (119.06) |

| (Decrease)/Increase in Payables | 6,601.46 | (753.03) |

| Cash Generated from Operations | 23,420.72 | 18,923.23 |

| Income Taxes Paid | (5,754.22) | (4,685.18) |

| Net Cash from Operating Activities | 17,666.50 | 14,238.05 |

| B. Cash Flow from Investing Activities | ||

| Investments Sales/(Purchase) – Net | 95.73 | 604.16 |

| Bank Deposit (Placed)/Matured – Net | (6,685.00) | 476.00 |

| Other Corporate Deposits (Placed)/Matured – Net | (2,000.00) | 2,000.00 |

| Interest Received | 1,512.87 | 1,311.76 |

| Net Proceeds from Mutual Fund Investments | 191.50 | 203.70 |

| Purchase of Property, Plant and Equipment | (2,446.19) | (4,779.54) |

| Changes in Earmarked Balances | 3,501.73 | (2,992.77) |

| Proceeds from Disposal of PPE | 14.96 | 220.25 |

| Net Cash (Used in)/from Investing Activities | (5,814.40) | (2,956.44) |

| C. Cash Flow from Financing Activities | ||

| Repayment of Lease Liabilities | (53.50) | (35.61) |

| Dividends Paid | (11,539.89) | (11,174.54) |

| Equity Shares Issued under ESOP | 0.02 | 0.13 |

| Interest and Finance Charges Paid | (20.77) | (16.71) |

| Net Cash (Used in) Financing Activities | (11,614.14) | (11,226.73) |

| Net Increase/(Decrease) in Cash and Cash Equivalents | 237.96 | 54.88 |

| Cash and Cash Equivalents at Beginning | 417.63 | 362.75 |

| Cash and Cash Equivalents at End | 655.59 | 417.63 |

Physical Properties

Swaraj Engines operates from two key physical locations in Mohali, Punjab, which serve as its operational and administrative hubs.

List of Physical Properties

- Registered Office:

- Location: Phase IV, Industrial Area, S.A.S. Nagar (Mohali), Punjab-160055

- Purpose: Administrative and corporate governance functions

- Details: Houses the company’s management, financial, and secretarial operations.

- Works (Manufacturing Facility):

- Location: Plot No. 2, Industrial Phase IX, S.A.S. Nagar (Mohali), Punjab-160062

- Purpose: Manufacturing of diesel engines, components, and spare parts

- Details: The facility is equipped for large-scale production, with 168,225 engines produced in FY 2024-25. It undergoes regular physical verification every three years, with no material discrepancies reported in FY 2022-23.

Comprehensive Details

- Title Deeds: The company holds title deeds for all immovable properties in its name, ensuring clear ownership.

- Physical Verification: The company has a program for physical verification of property, plant, and equipment, conducted once every three years, with the last verification in FY 2022-23 confirming no material discrepancies.

- Asset Value: As of March 31, 2025, the value of property, plant, and equipment is Rs. 6,572.33 lakhs, with capital work-in-progress at Rs. 148.62 lakhs and intangible assets at Rs. 22.34 lakhs.

Founders Details

The provided document does not explicitly mention the founders of Swaraj Engines Limited. As a public limited company established in 1985, it is likely that the company was founded through a corporate initiative, possibly involving key stakeholders or a parent entity. However, specific details about individual founders are not available in the report.

Board of Directors

The board of directors of Swaraj Engines Limited comprises experienced professionals who guide the company’s strategic and operational decisions.

List of Directors

- Rajesh Jejurikar:

- Role: Chairman

- DIN: 00046823

- Details: Retires by rotation at the 39th AGM and is eligible for re-appointment.

- S. Nagarajan:

- Role: Director

- Details: Part of the board, contributing to strategic oversight.

- Nikhilesh Panchal:

- Role: Director

- Details: Involved in governance and compliance activities.

- Smita Mankad:

- Role: Director

- Details: Provides expertise in corporate governance and policy.

- Rajya Vardhan Kanoria:

- Role: Director

- Details: Contributes to strategic planning and board deliberations.

- Harish Chavan:

- Role: Director

- DIN: 06890989

- Details: Retires by rotation at the 39th AGM and is eligible for re-appointment.

- Puneet Renjhen:

- Role: Director

- Details: Supports the board in operational and financial decisions.

- Devjit Sarkar:

- Role: Whole Time Director & Chief Executive Officer

- DIN: 10745850

- Details: Oversees day-to-day operations and strategic execution.

Investment Details

Swaraj Engines has investments in financial assets, primarily quoted investments, as part of its financial strategy. The details are as follows:

List of Investments

- Quoted Investments:

- Value (FY 2024-25): Rs. 10,950.00 lakhs (unchanged from FY 2024)

- Income Generated: Rs. 747.92 lakhs (calculated based on Return on Investments of 6.83%)

- Details: These are financial assets measured at Fair Value Through Profit or Loss (FVTPL), contributing to other income.

- Other Investments:

- Bank Deposits: Rs. 6,685.00 lakhs (net placed in FY 2025)

- Corporate Deposits: Rs. 2,000.00 lakhs (net placed in FY 2025)

- Revenue Breakup: Investment income forms part of other income (Rs. 1,641.37 lakhs, or 0.97% of total income).

Comprehensive Details

- The company’s investments are primarily in secure financial instruments, with no significant change in quoted investments from FY 2024 to FY 2025.

- The return on investments increased slightly from 6.77% in FY 2024 to 6.83% in FY 2025, indicating stable performance.

- The company does not have investments in subsidiaries, associates, or joint ventures, as confirmed by the auditors’ report.

Future Investment Plan

The document does not provide explicit details on future investment plans. However, based on the company’s financial activities and strategic focus, the following inferences can be made:

- Capital Expenditure: The purchase of property, plant, and equipment worth Rs. 2,446.19 lakhs in FY 2025 suggests ongoing investments in manufacturing capacity and infrastructure upgrades.

- Financial Investments: The company’s continued placement of bank and corporate deposits (Rs. 6,685.00 lakhs and Rs. 2,000.00 lakhs, respectively) indicates a strategy to maintain liquidity and generate stable returns.

- Dividend Policy: The proposed dividend of Rs. 104.50 per share reflects a commitment to shareholder returns, potentially limiting aggressive capital investments in the short term.

- Operational Growth: The increase in production and despatches (168,225 and 168,820 units, respectively) suggests potential investments in production efficiency and capacity expansion to meet growing demand.

Conclusion

Swaraj Engines Limited stands as a robust and focused player in the diesel engine manufacturing sector, with a strong operational base in Mohali, Punjab. Its single-segment business model, centered on diesel engines and components, has driven consistent financial growth, with net operating revenue reaching Rs. 168,189.23 lakhs in FY 2024-25. The company’s commitment to corporate governance, transparent financial reporting, and shareholder value is evident through its dividend payouts, compliance with regulatory standards, and robust internal controls. With a strong board of directors, a clear operational focus, and a stable financial position, Swaraj Engines is well-positioned to continue its growth trajectory in the agricultural machinery sector.