Here we can see about the telecom industry in India. India is currently the second-largest telecommunication market and has the second-highest number of internet users in the world. India’s total customer base stood at 1,204.85 million at the end of Oct-19. There are totally Three Private companies and One Public company.

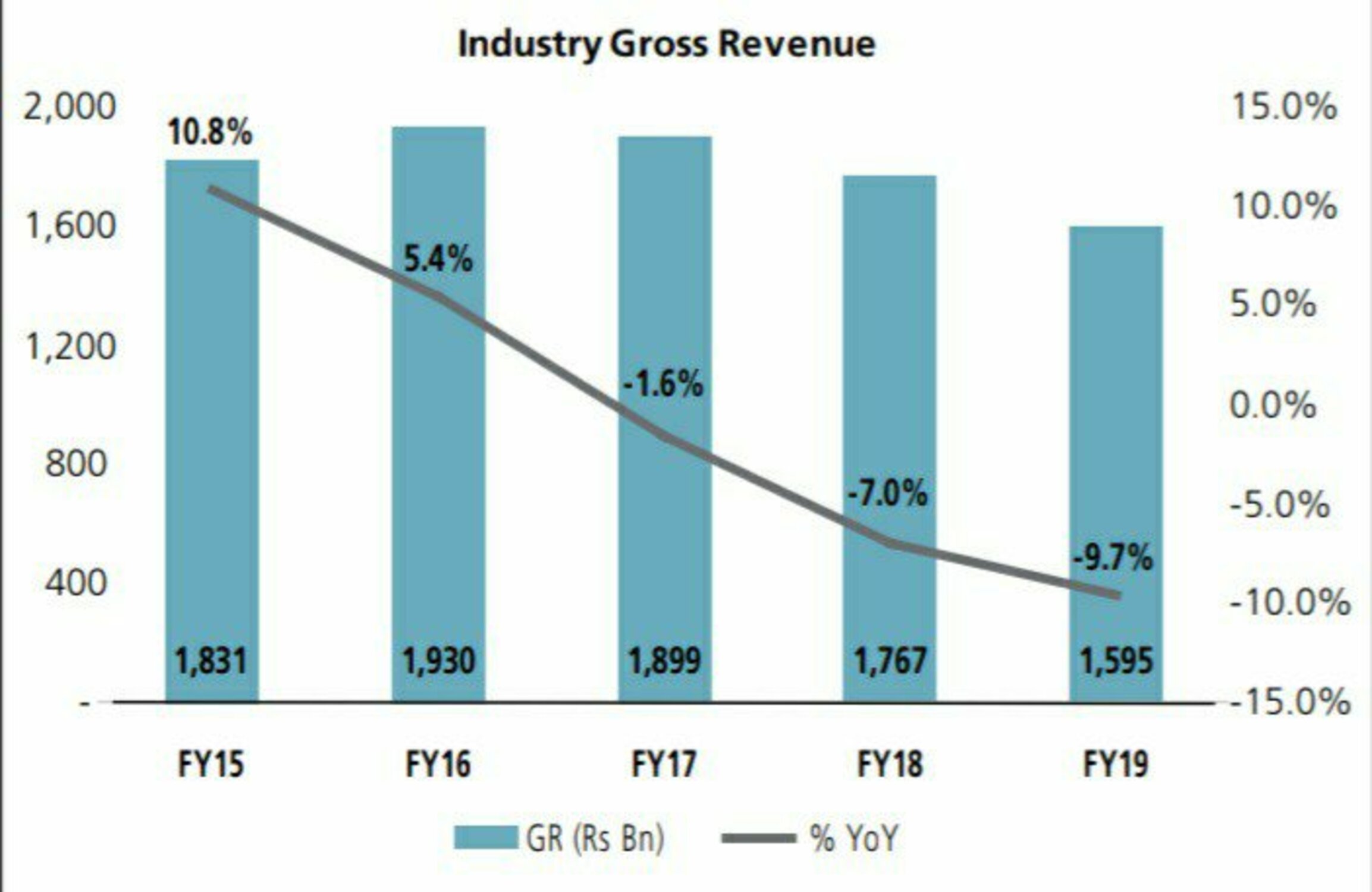

All the operators have been selling aggressive unlimited voice bundled data plans which are heavily discounted, in order to defend their subscriber base which has led to significant ARPU erosion. This has led to worsening financial distress for the operators and shrinking the overall revenue of the industry.

Telecom Industry in India

The number of active wireless subscribers in October 2019 was 981.19 million. Urban telephone subscription Stood at 681.69 million at the end of Oct-19, and the rural subscription stood at 523.16 million.

Wireless Subscribers

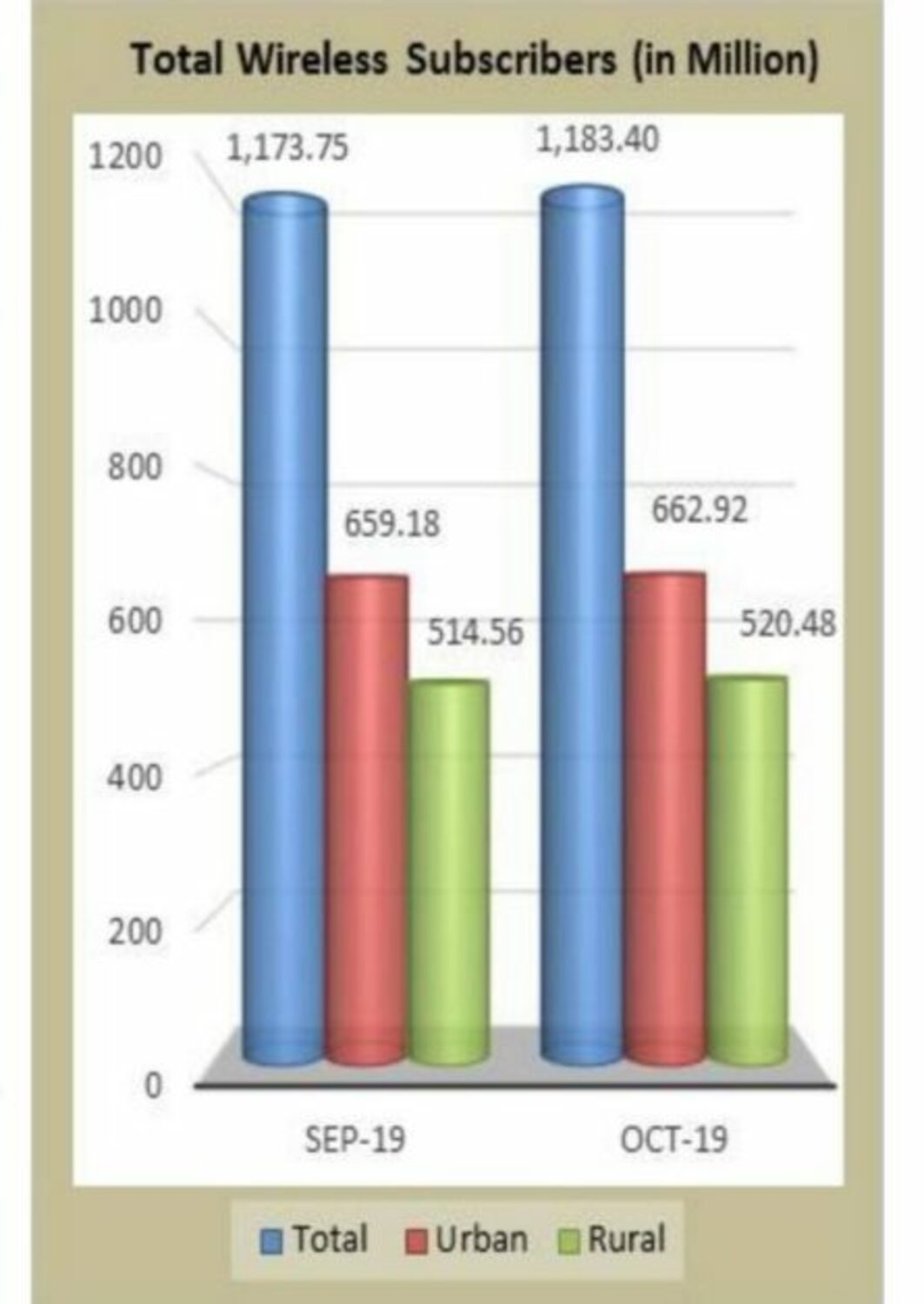

The Indian wireless industry has continued to remain under significant stress with unrelenting pricing pressure since the launch of the new 4G mobile operator in September 2016. This is the chart that shows wireless subscribers from telecom industry in India.

Total wireless subscribers (2G, 3G & 4G) increased from 1,173.75 million at the end of Sep-19 to 1,183.40 million at the end of Oct-19, thereby registering a monthly growth rate of 0.82%.

Wireless subscription in urban areas increased from 659.18 million at the end of Sep-19 to 662.92 million at the end of Oct-19, and wireless subscription in rural areas also increased from 514.56 million at the end of Sep-19 to 520.48 million at the end of Oct-19. Monthly growth rates of urban and rural wireless subscription were 0.57% and 1.15% respectively.

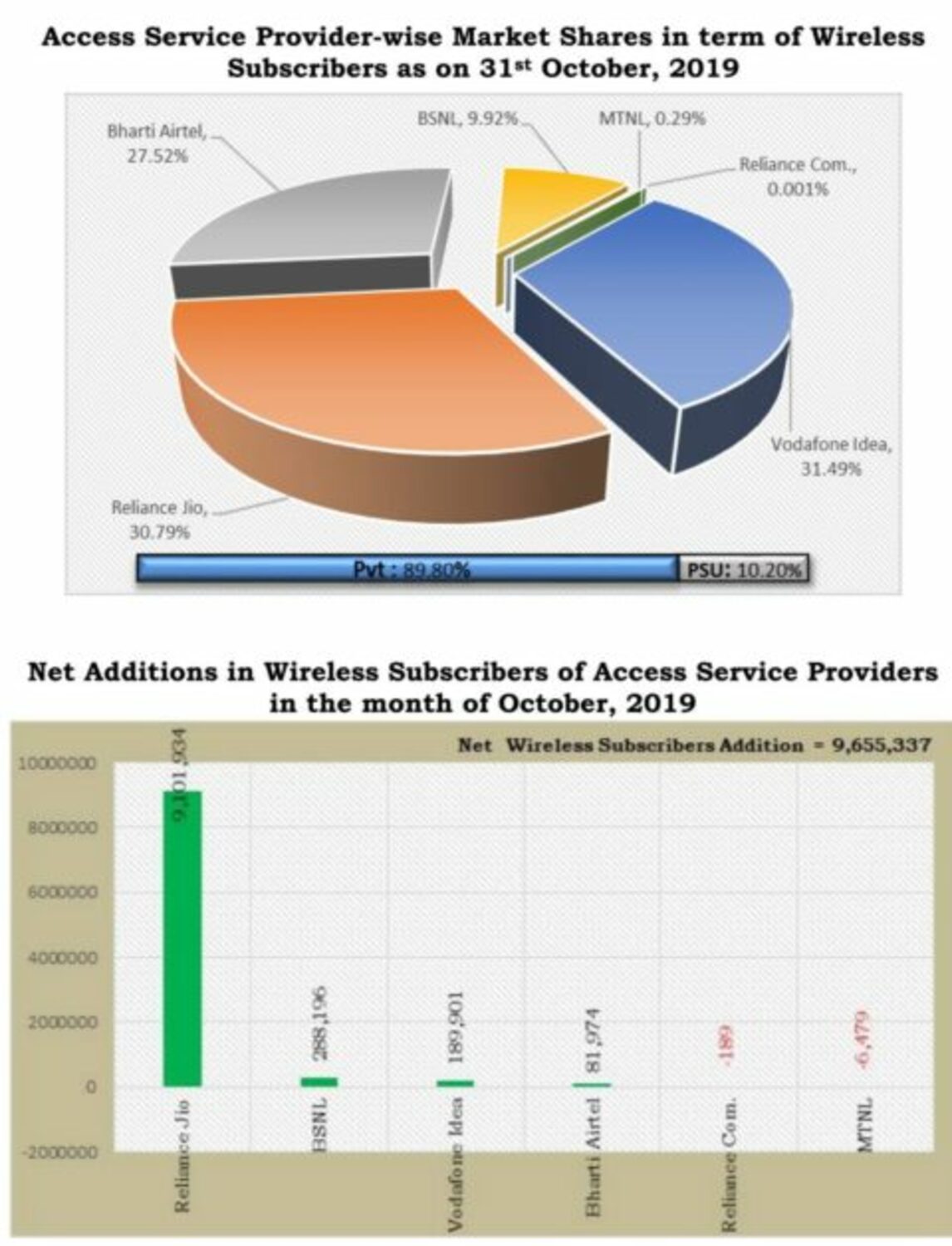

Market share of Wireless Subscribers

As on 31st October 2019, the private access service providers held 89.80% market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 10.20%. The graphical representation of access service provider-wise market share and net additions in wireless subscriber base are given below:

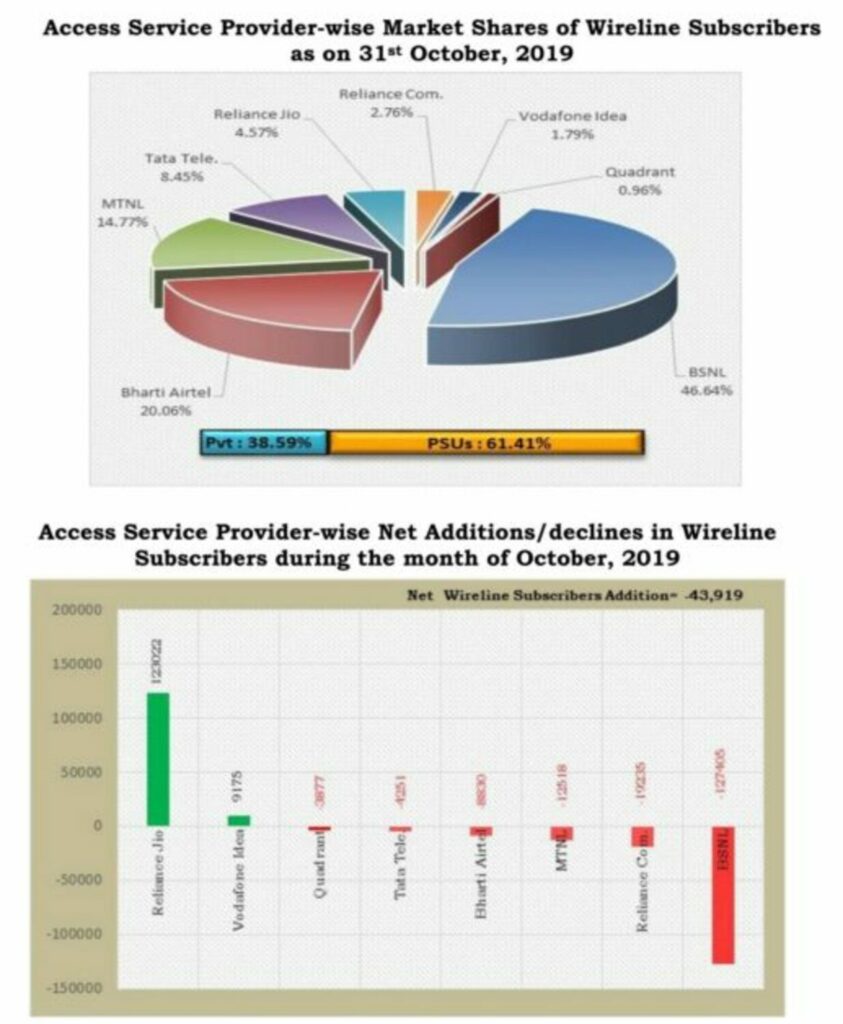

Wireline Subscribers

• Wireline subscribers declined from 21.49 million at the end of Sep-19 to 21.45 million at the end of Oct-19. Net decline in the wireline subscriber base was 0.04 million with a monthly decline rate of 0.20%. The share of urban and rural subscribers in total wireline subscribers were 87.49% and 12.51% respectively at the end of Oct-19.

Market share of wireline subscriber

BSNL and MTNL, the two PSU access service providers, held 61.41% of the wireline market share as on 31st October, 2019. Detailed statistics of wireline subscriber base are available.

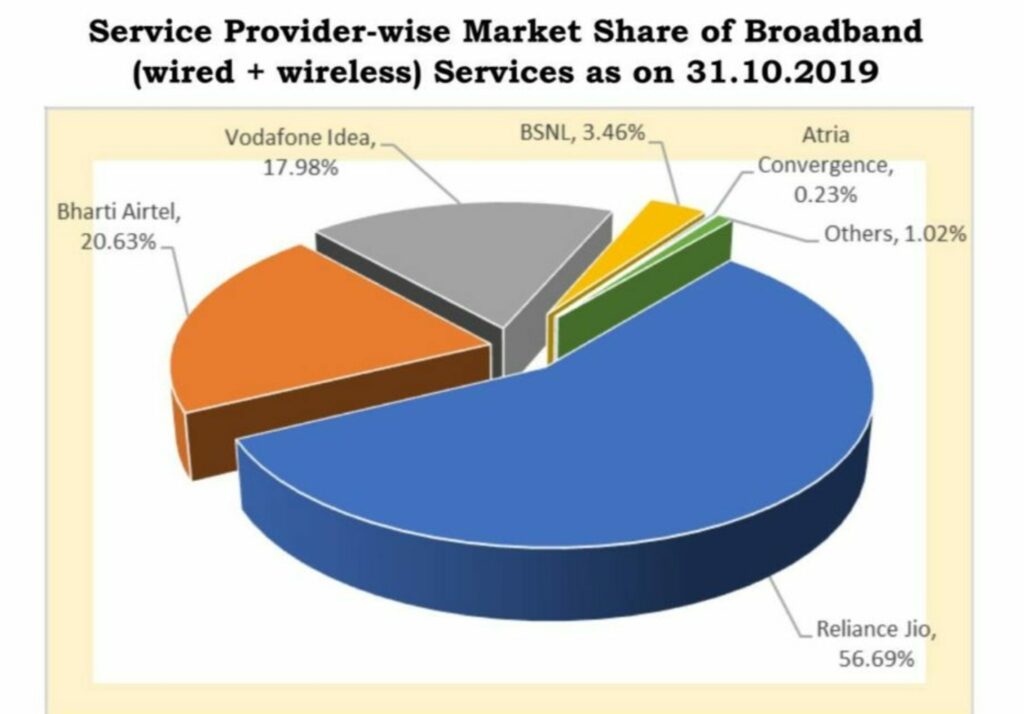

Market share of Broadband

Top five service providers constituted 98.98% market share of the total broadband subscribers at the end of Oct-19. These service providers were Reliance Jio Infocom Ltd (365.12 million), Bharti Airtel (132.86 million), Vodafone Idea (115.80 million), BSNL (22.27 million) and Atria Convergence (1.49 million).

The top five Wireless Broadband Service providers were

- Reliance Jio Infocom Ltd (364.33 million),

- Bharti Airtel (130.45 million),

- Vodafone Idea (115.78 million),

- BSNL (13.64 million) and

- MTNL (0.20 million).

The top five Wired Broadband Service providers were

- BSNL (8.62 million),

- Bharti Airtel (2.40 million),

- Atria Convergence Technologies (1.49 million),

- Hathway Cable & Datacom (0.87 million) and

- Reliance Jio Infocomm Ltd (0.79 million).

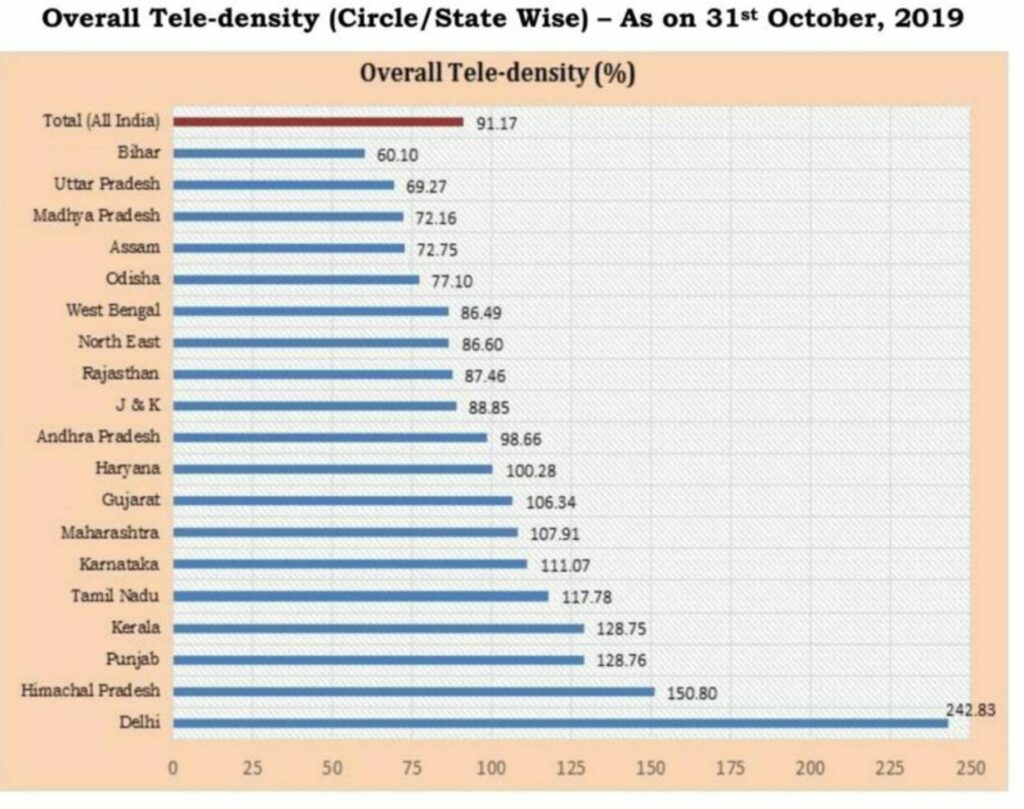

Tele-density in India

The overall Tele-density in India increased from 90.52 at the end of Sep-19 to 91.17 at the end of Oct-19. The Urban Tele-density increased from 160.63 at the end of Sep-19 to 161.27 at the end of Oct-19.

Rural Teledensity also increased from 57.59 at the end of Sep-19 to 58.21 at the end of Oct-19. The share of rural and urban subscribers in total number of telephone subscribers at the end of Oct-19 was 56.58% and 43.42% respectively. This is the chart show teledensity from the telecom industry in India in each state.

As may be seen in the above chart, nine states have less teledensity than the all India average teledensity at the end of Oct-19. Delhi service area has a maximum teledensity of 242.83 and the Bihar service area has a minimum teledensity of 60.10 at the end of October 2019.

Here is the List of top telecom companies in India.

![Top 12 Telecom Cable Manufacturers [Companies] in India](https://indiancompanies.in/wp-content/uploads/2020/09/Top-12-Telecom-Cable-Manufacturers-Companies-in-India.jpg)

Dear purchasing manager,

Sorry to trouble.

Our company is mainly engaged in various types of diesel injection pumps, diesel pump plungers, fuel injectors, high-pressure fuel pipes, various types of brake pads, and brake discs. And so on all kinds of fuel vehicle related accessories.

The lowest cost, highest quality, most complete specifications.

Welcome to consultation..