NIFTY Realty Index is designed to reflect the behavior and performance of Real Estate companies. The Index comprises of 10 companies listed on the National Stock Exchange of India (NSE). The index comprises of a maximum of 10 stocks. The base date of the index is December 29, 2006, and the base value of 1000 points.

- Base Date: December 29, 2006

- Base Value: 1000

- Launch Date: August 30, 2007

- No of Constituents: 10

NIFTY Realty Index is computed using the free-float market capitalization method, wherein the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value. NIFTY Realty Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

Top Companies by weightage

The following are the Weightage of the each stock in the Index. DLF Ltd has the highest Weightage in the Index with a weightage of 31.67%. Top Three stocks have weightage of more than 60%

- DLF Ltd. 31.67 % Stock Weightage

- Godrej Properties Ltd. 16.01 % Stock Weightage

- Oberoi Realty Ltd. 14.01 % Stock Weightage

- Phoenix Mills Ltd. 9.95 % Stock Weightage

- Prestige Estates Projects Ltd. 7.96 % Stock Weightage

- Brigade Enterprises Ltd. 5.17 % Stock Weightage

- Sobha Ltd. 4.40 % Stock Weightage

- Sunteck Realty Ltd. 4.39 % Stock Weightage

- Indiabulls Real Estate Ltd. 4.18 % Stock Weightage

- Mahindra Lifespace Developers Ltd. 2.25 % Stock Weightage

The Top Five stocks have a Weightage of more than 75% in the Index. Mahindra Lifespace Developers Ltd has the Lowest Weightage in the Index with a Weightage of Just 2.25%.

Nifty Realty Index stocks with Symbol

The table below shows the List of stocks in the Nifty realty sector with Symbol and ISIN Code. The NIFTY Realty Index is designed to reflect the behavior and performance of the companies that are engaged in the construction of residential & commercial real estate properties. The list is Arranged in Alphabetical Order.

| Company Name | Symbol | ISIN Code |

| Brigade Enterprises Ltd. | BRIGADE | INE791I01019 |

| DLF Ltd. | DLF | INE271C01023 |

| Godrej Properties Ltd. | GODREJPROP | INE484J01027 |

| Indiabulls Real Estate Ltd. | IBREALEST | INE069I01010 |

| Mahindra Lifespace Developers Ltd. | MAHLIFE | INE813A01018 |

| Oberoi Realty Ltd. | OBEROIRLTY | INE093I01010 |

| Phoenix Mills Ltd. | PHOENIXLTD | INE211B01039 |

| Prestige Estates Projects Ltd. | PRESTIGE | INE811K01011 |

| Sobha Ltd. | SOBHA | INE671H01015 |

| Sunteck Realty Ltd. | SUNTECK | INE805D01034 |

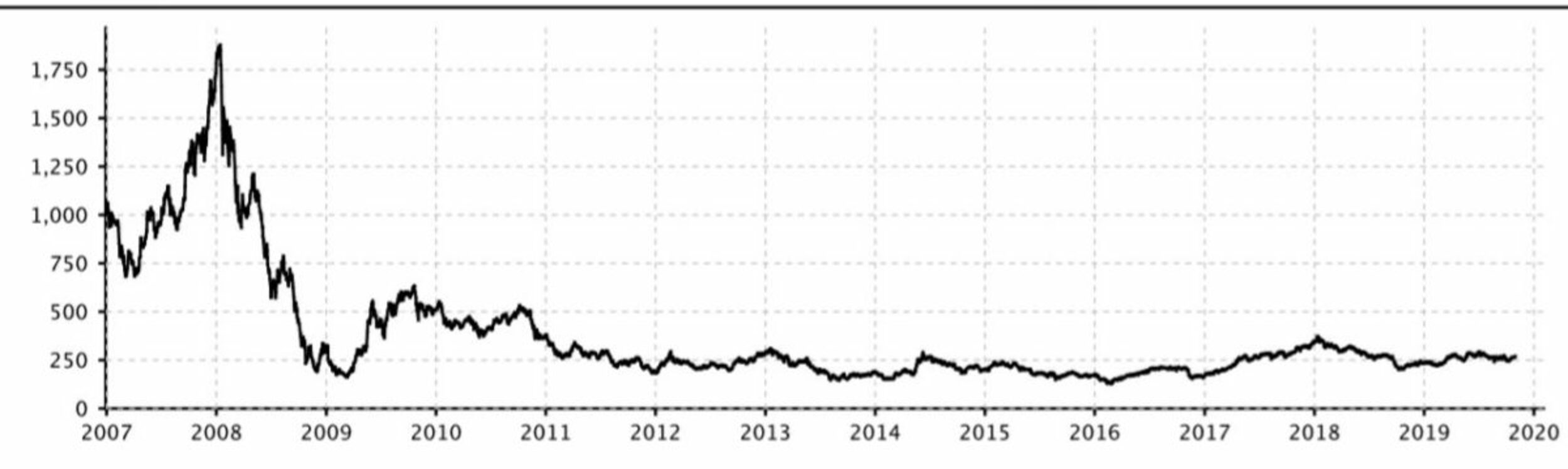

Historical Data Chart

This is the Chart that Shows return From the year 2007 to 2020. The Indices has given a total return of -8.74 % which has given a negative return for the last 14 years.

Below is the Historical chart of the Nifty Realty Index.

This sector is the underperformance sector when compared to other sector indices. The risk in the sector is very high.

Fundamental PE (P/E) and PB (P/B) Ratio and Dividend Yield of Private Bank index

- P/E: 30.8

- P/B: 2.86

- Dividend Yield: 0.44

good companies