Aditya Birla Group is a US $48.3 billion corporation. Founded in 1857: Seth Shiv Narayan Birla commences cotton trading operations at Pilani, Rajasthan sets the foundation of the Birla Group of Companies. Globally, the Aditya Birla Group is

- 1st in aluminium rolling, viscose staple fibre and carbon black

- 2nd in telecom

- 3rd in cement (excluding China)

- 3rd largest producer of insulators

Aditya Birla Group

Aditya Birla Group is in the League of Fortune 500. An extraordinary force of over 120,000 employees, belonging to 42 nationalities. Over 50 percent of its revenues flow from its overseas operations spanning 34 countries. In India, the Group leads in several sectors,

- No. 1 fashion (branded apparel) and lifestyle player,

- No. 1 mobile telephony company,

- The 2nd largest player in viscose filament yarn,

- The largest producer in the Chlor-alkali sector,

- No. 1 player in grey cement, white cement, and concrete,

- A leading player in life insurance and asset management.

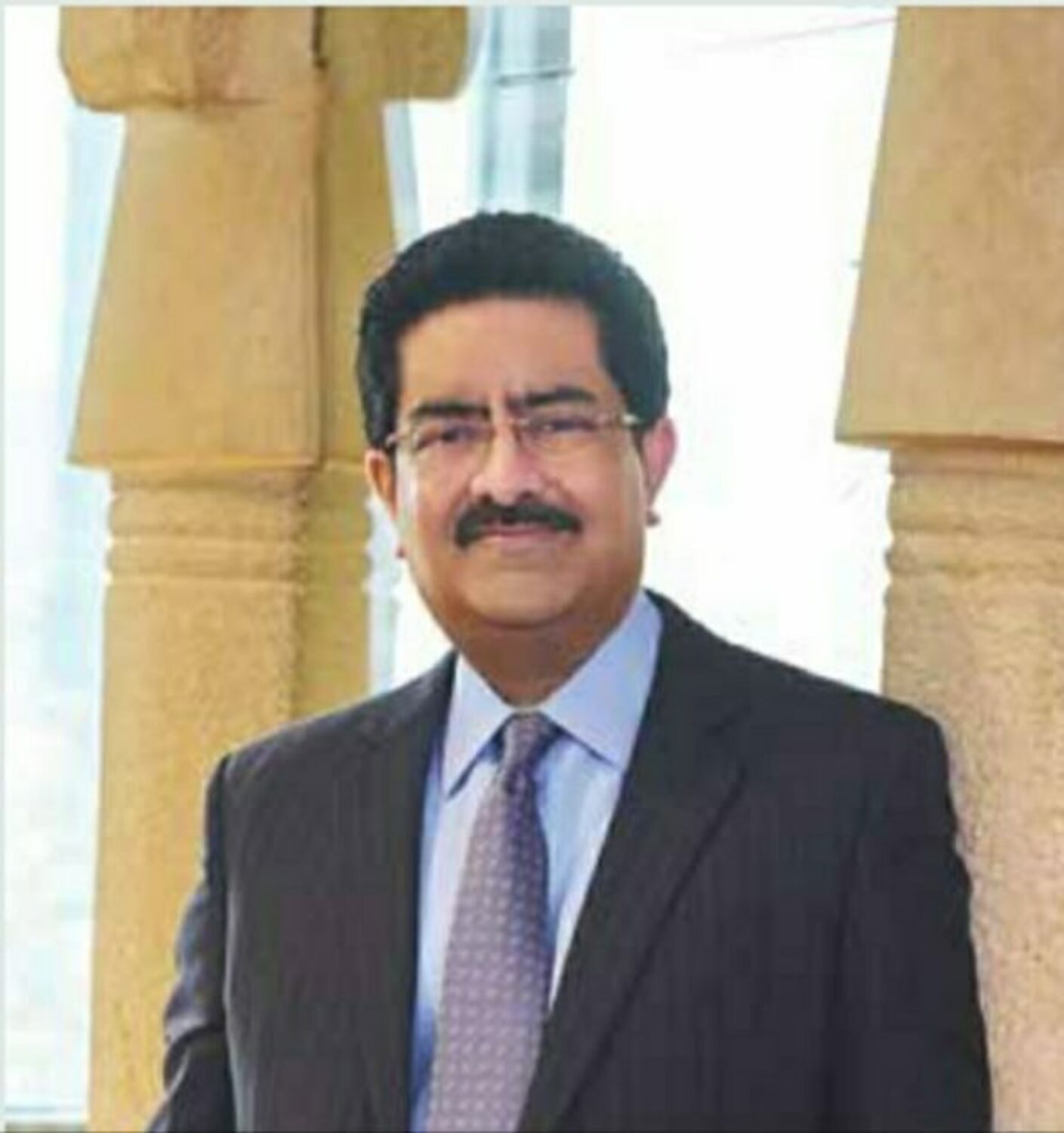

Group Chairman | Owner

Mr. Kumar Mangalam Birla is a Chartered Accountant and holds an MBA degree from the London Business School. Mr. Birla chairs the Boards of all major Group companies in India and globally.

In India, apart from chairing Company’s Board, he also chairs the Boards of UltraTech Cement Limited, Hindalco Industries Limited, Vodafone Idea Limited, and Aditya Birla Capital Limited. In the 23 years, that he has been at the helm of the Group, he has accelerated growth, built meritocracy and enhanced stakeholder value.

Aditya Birla Group Companies [ Aditya Birla Group Subsidiaries ]

Here is the List of Top Aditha Birla Group Companies [ Aditya Birla Group Subsidiaries ] based on Revenue in the Recent year

1. Grasim Industries Limited

- Sales₹ 1,20,651 Cr.

- Operating profit₹ 21,941 Cr.

- Net profit₹ 10,896 Cr.

- Sales last year₹ 1,17,627 Cr.

- EBIDT last year₹ 25,331 Cr.

Incorporated in 1947, Grasim Industries Limited is a flagship company of the Aditya Birla Group. It started as a textile manufacturer in India in 1947. Today, it is a leading global player in VSF and the largest chemicals (Chlor-Alkali-s) player in India.

It is also the largest cement producer and diversified financial services (NBFC, Asset Management, and Life Insurance) player in India through its subsidiaries UltraTech Cement and Aditya Birla Capital.

- Total Assets₹ 3,36,823 Cr.

- Reserves₹ 78,610 Cr.

- Debt₹ 1,03,027 Cr.

- Debt to equity1.31

- Dividend yield0.53 %

- Face value₹ 2.00

- ROE 5Yr8.13 %

- ROCE9.97 %

- ROCE 3Yr9.36 %

- Return on equity8.85 %

Grasim Industries Limited is the Diversified Company Have Presence in Cement, Textiles, Fiber, VSF, Chemicals, and Financial Services. It is one of the main Aditya Birla Group Subsidiaries.

2. Hindalco Industries Limited

Hindalco Industries Limited is the metals flagship aditya birla group subsidiaries. With a consolidated turnover of US$18.7 billion, Hindalco is an industry leader in aluminium and copper. It is the Largest in the list of aditya birla group subsidiaries based on Turnover.

- Sales₹ 2,18,175 Cr.

- Operating profit₹ 19,951 Cr.

- Net profit₹ 8,432 Cr.

- Sales last year₹ 2,23,202 Cr.

- EBIDT last year₹ 23,973 Cr.

Hindalco’s acquisition of Aleris Corporation in April 2020, through its subsidiary Novelis Inc., has cemented the company’s position as the world’s largest flat-rolled products player and recycler of aluminium.

Hindalco’s state-of-art copper facility comprises a world-class copper smelter and a fertiliser plant along with a captive jetty. The copper smelter is among Asia’s largest custom smelters at a single location.

In India, the company’s aluminium units across the country encompass the gamut of operations from bauxite mining, alumina refining, coal mining, captive power plants and aluminium smelting to downstream rolling, extrusions and foils. Today, Hindalco ranks among the global aluminium majors as an integrated producer and a footprint in 9 countries outside India.

- Total Assets₹ 2,23,489 Cr.

- Reserves₹ 94,584 Cr.

- Debt₹ 60,291 Cr.

- Debt to equity0.64

- Dividend yield0.63 %

- Face value₹ 1.00

- ROE 5Yr10.7 %

- ROCE11.3 %

- ROCE 3Yr12.2 %

- Return on equity11.7 %

The Birla Copper unit produces copper cathodes and continuous cast copper rods, along with other by-products, including gold, silver, and DAP fertilisers. It is India’s largest private producer of gold. It is largest in Aditya Birla Group Subsidiaries.

Hindalco has been accorded Star Trading House status in India. Its aluminium is accepted for delivery under the High-Grade Aluminium Contract on the London Metal Exchange (LME), while its copper quality is also registered on the LME with Grade A accreditation.

3. UltraTech Cement Limited

- Sales₹ 65,813 Cr.

- Operating profit₹ 10,573 Cr.

- Net profit₹ 5,182 Cr.

- Sales last year₹ 63,240 Cr.

- EBIDT last year₹ 11,095 Cr.

UltraTech is today the 3rd largest cement company in the World, excluding China with a consolidated capacity of 102.75 million tonnes per annum of grey cement (including 4.00 million tonnes per annum under commissioning) and the largest manufacturer of grey cement, ready-mix concrete and white cement in India.

UltraTech is India’s No. 1 cement and concrete brand. UltraTech has an operational presence in five countries (India, UAE, Bahrain, Bangladesh and Sri Lanka). Ultra tech is the largest in the list of aditya birla group subsidiaries based on the market Capital.

In India, UltraTech’s distribution network comprises a network of 49 cement plants, over 100 ready mix concrete plants, more than 650 warehouses and more than 200 railheads.

- Total Assets₹ 91,380 Cr.

- Reserves₹ 54,036 Cr.

- Debt₹ 11,058 Cr.

- Debt to equity0.20

- Dividend yield0.46 %

- Face value₹ 10.0

- ROE 5Yr12.4 %

- ROCE12.9 %

- ROCE 3Yr14.0 %

- Return on equity9.63 %

UltraTech services 20,000 orders of different order sizes on a daily basis through a mix of logistical modes comprising rail, road, and sea. It is one of the Highly Profitable Aditya Birla Group Subsidiaries

4. Vodafone Idea Limited

- Sales₹ 42,423 Cr.

- Operating profit₹ 16,645 Cr.

- Net profit₹ -29,844 Cr.

- Sales last year₹ 42,177 Cr.

- EBIDT last year₹ 17,036 Cr.

Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group partnership. It is India’s leading telecom service provider. The Company provides pan India Voice and Data services across 2G, 3G and 4G platform. With the large spectrum portfolio to support the growing demand for data and voice.

- Total Assets₹ 2,07,243 Cr.

- Reserves₹ -1,23,039 Cr.

- Debt₹ 49,411 Cr.

The Company is developing infrastructure to introduce newer and smarter technologies, making both retail and enterprise customers future ready with innovative offerings, conveniently accessible through an ecosystem of digital channels as well as extensive on-ground presence. The Company is listed on National Stock Exchange (NSE) and BSE in India.

5. Aditya Birla Fashion & Retail Limited

ABFRL is a part of USD 48.3 billion Aditya Birla Group. With revenue of Rs. 8,743 cr. and spanning a retail space of 8.1 million sq.ft. (as on March 31, 2020), it is India’s first billion-dollar pure-play fashion powerhouse with an elegant bouquet of leading fashion brands and retail formats.

ABFRL emerged after the consolidation of the branded apparel businesses of Aditya Birla Group comprising ABNL’s Madura Fashion division and ABNL’s subsidiaries —

- Pantaloons Fashion and Retail (PFRL) and

- Madura Fashion & Lifestyle (MFL).

Post the consolidation, PFRL was renamed Aditya Birla Fashion and Retail Ltd. ABFRL brings together the learnings and businesses of two renowned Indian fashion icons, Madura Fashion & Lifestyle and Pantaloons creating a synergistic core that will act as the nucleus of the future fashion businesses of the Aditya Birla Group.

- Sales₹ 12,739 Cr.

- Operating profit₹ 1,317 Cr.

- Net profit₹ -316 Cr.

- Sales last year₹ 12,418 Cr.

- EBIDT last year₹ 1,638 Cr.

- Retail space of 8.1 million sq.ft.

As a fashion conglomerate, ABFRL has a strong network of 3,031 brand stores across the country. It is present across 25,000 multi-brand outlets and 6,000+ point of sales in department stores across India. It has a repertoire of leading brands such as Louis Philippe, Van Heusen, Allen Solly and Peter England established for over 25 years.

Pantaloons is one of India’s largest value fashion store brand. The International Brands portfolio boasts of – The Collective, India’s largest multi-brand retailer of international brands and select mono-brands such as Simon Carter, Ted Baker, Hackett London, Ralph Lauren, American Eagle and Fred Perry.

- Total Assets₹ 16,790 Cr.

- Reserves₹ 1,920 Cr.

- Debt₹ 6,573 Cr.

- Debt to equity2.29

- Dividend yield0.00 %

- Face value₹ 10.0

- ROE 5Yr%

- ROCE5.03 %

- ROCE 3Yr1.10 %

- Return on equity-2.20 %

The Company brand portfolio also includes Skult catering to the needs of young masses category of the customers. Our portfolio of regional brands includes ‘Van Heusen Innerwear’ & ‘Style Up’. Additionally, The Company closed two strategic investments in branded ethnic wear business with Jaypore and Shantanu & Nikhil.

6. Aditya Birla Capital Limited

- Sales₹ 28,833 Cr.

- Operating profit₹ 8,488 Cr.

- Net profit₹ 5,066 Cr.

- Sales last year₹ 30,163 Cr.

- EBIDT last year₹ 10,502 Cr.

Aditya Birla Capital Limited (ABCL) is the holding company of all the financial services businesses. Aditya Birla Capital has a strong presence across a wide range of Protecting, Investing and Financing Solutions, which include Life Insurance, Health Insurance, Motor Insurance, Corporate General Insurance, Mutual Funds, Wealth Management.

- Total Assets₹ 1,80,353 Cr.

- Reserves₹ 17,893 Cr.

- Debt₹ 84,738 Cr.

- Debt to equity4.17

- Dividend yield0.00 %

- Face value₹ 10.0

- ROE 5Yr14.1 %

- ROCE11.4 %

- ROCE 3Yr9.10 %

- Return on equity26.8 %

Also, the Company has Presence in Stocks and Securities Broking, Portfolio Management Services, Real Estate Investments, Pension Funds, Home Finance, Personal Finance, SME Finance, Real Estate Finance, Loan Against Securities, Corporate Finance, Debt Capital Markets, Loan Syndication and Asset Reconstruction.

![Indiabulls Group Stocks [Companies] Owner](https://indiancompanies.in/wp-content/uploads/2021/01/Indiabulls-Group-Stocks-Companies-Owner.png)

Experience world class online stock market brokerage service in Bangladesh.

Midway Securities Ltd.is one of the oldest, most prominent and well recognized Securities Brokerage house in the Dhaka

please change the title BRILA (SPELLED WRONGLY) IT SHOULD BE BIRLA

ha ha ha

Really shiv narayan is success guy