Here we can Discus Bank nifty Index weightage and the list of stock in the Index. The Index comprises of the most liquid and large Indian Banking stocks. It provides investors and market intermediaries a benchmark that captures the capital market performance of the Indian banks.

What is NSE Bank Nifty Index

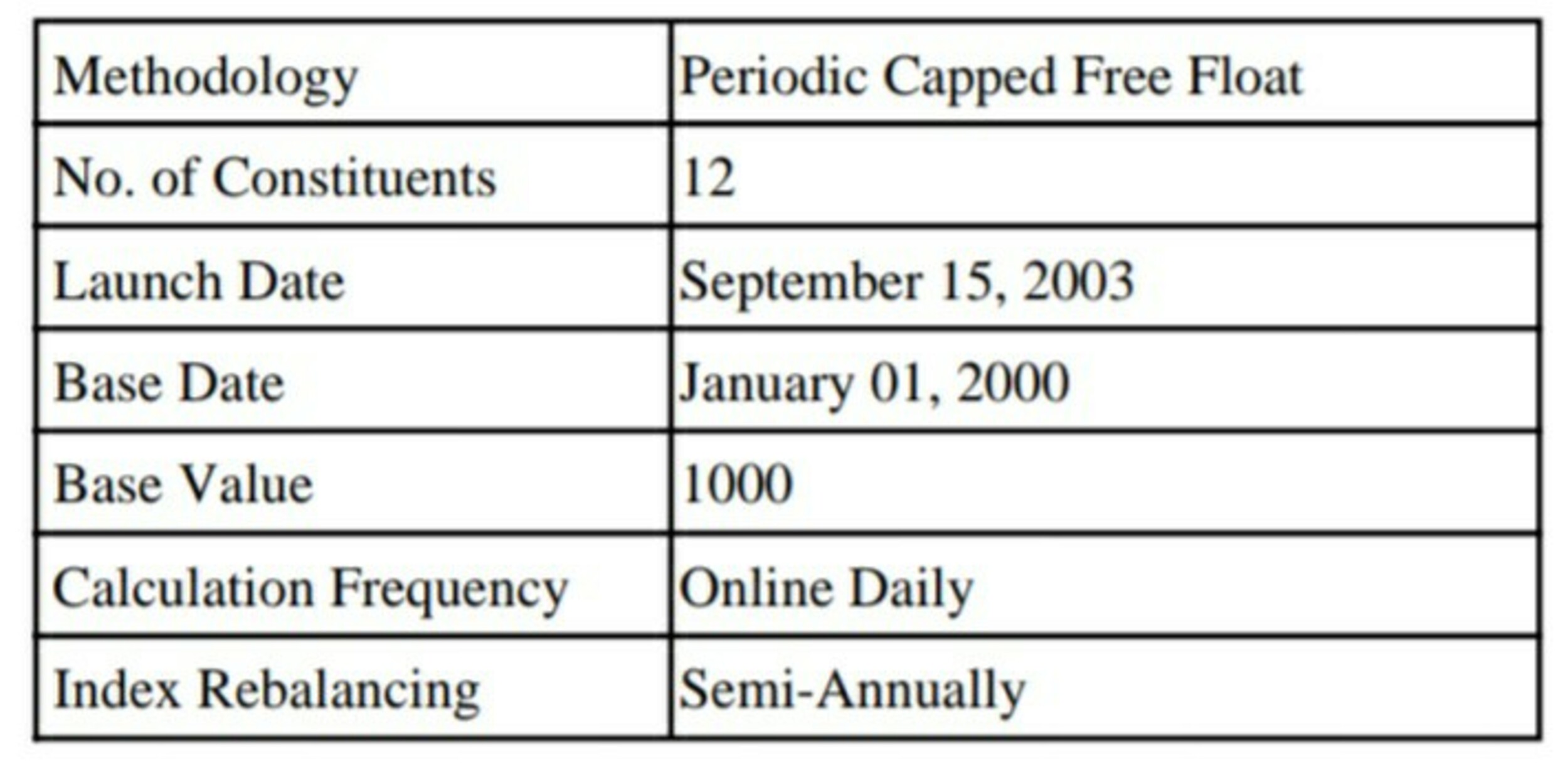

The Index comprises of a maximum of 12 companies listed on the National Stock Exchange of India (NSE). The base date of the index is January 1, 2000, and a base value of 1000 points.

Bank Index is computed using the free-float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

Read more about Top Government banks in India.

Bank Nifty NSE Top constituents by weightage

So here is the list of stocks with weightage. The weightage of the stock is arranged in order from high weightage to low weightage.

- HDFC Bank Ltd – 33 % Stocks Weightage

- ICICI Bank Ltd – 26 % Stocks Weightage

- Kotak Mahindra Bank Ltd – 13 % Stocks Weightage

- Axis Bank Ltd – 11 % Stocks Weightage

- State Bank of India – 9 % Stocks Weightage

- IndusInd Bank Ltd – 3 % Stocks Weightage

- Federal Bank Ltd – 1 % Stocks Weightage

HDFC Bank has the highest weightage in the bank nifty Index followed by ICICI Bank limitd, Kotak Mahindra Bank Ltd.

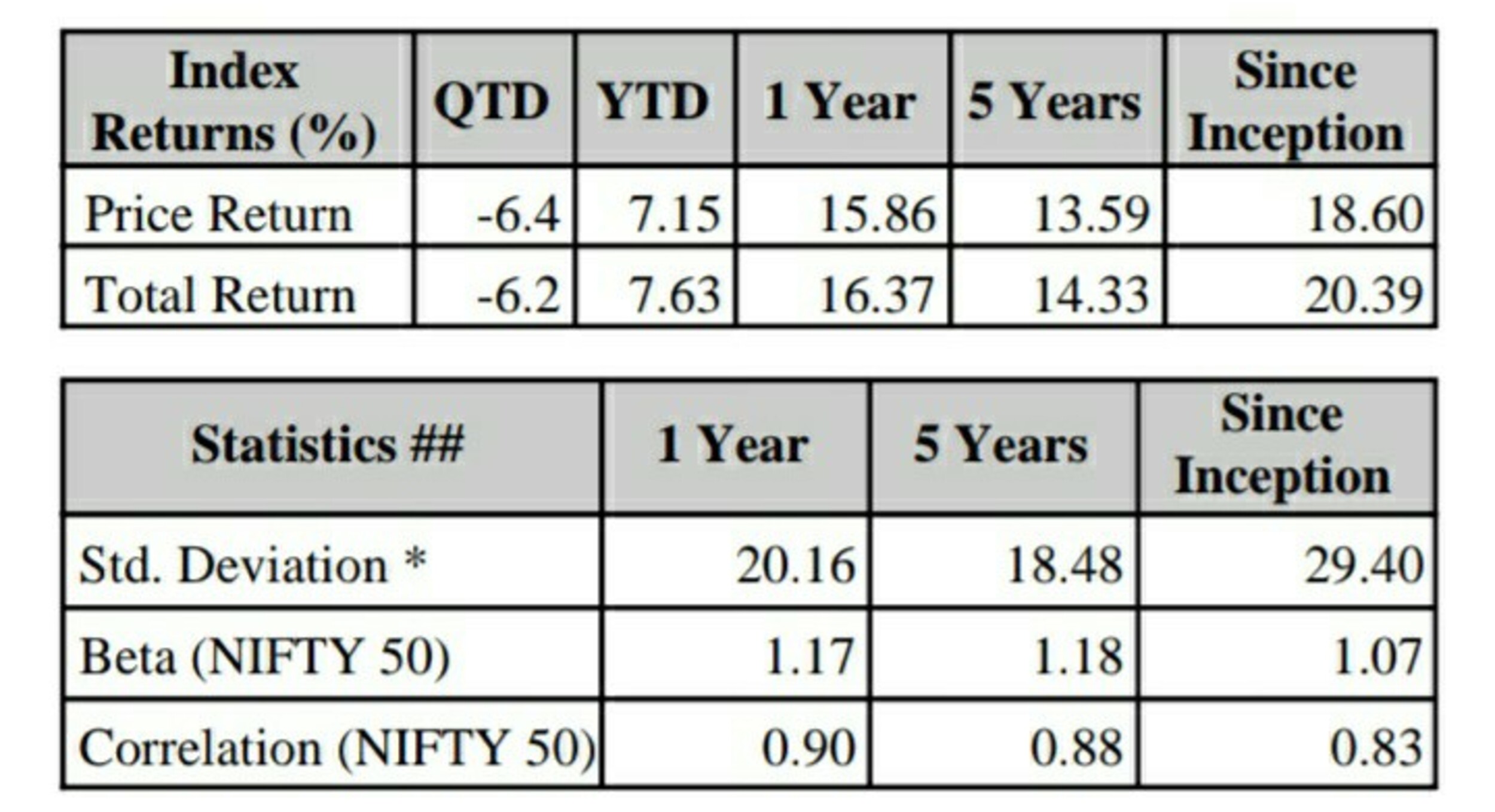

NSE Bank Nifty Indices Historical Return

Bank Nifty Index has given the historical return of 20.4% CAGR for the last 20 years since the inception year 2000. For the Last Five years, it has given the return of 14.33 % CAGR

NSE Bank Nifty Index Stocks

The following are the list of bank stocks. The List was given in alphabetical order.

| S.No | Stock | Bank weight % | Symbol | Sector |

| 1 | HDFC Bank Ltd | 33.6 | HDFCBANK | Financials |

| 2 | ICICI Bank Ltd | 26.0 | ICICIBANK | Financials |

| 3 | Kotak Mahindra Bank Ltd | 13.2 | KOTAKBANK | Financials |

| 4 | Axis Bank Ltd | 10.5 | AXISBANK | Financials |

| 5 | State Bank of India | 9.4 | SBIN | Financials |

| 6 | Indusind Bank Ltd | 2.6 | INDUSINDBK | Financials |

| 7 | Bandhan Bank Ltd | 1.1 | BANDHANBNK | Financials |

| 8 | AU Small Finance Bank Ltd | 1.1 | AUBANK | Financials |

| 9 | Federal Bank Ltd | 0.9 | FEDERALBNK | Financials |

| 10 | IDFC First Bank Ltd | 0.7 | IDFCFIRSTB | Financials |

| 11 | Punjab National Bank | 0.6 | PNB | Financials |

| 12 | RBL Bank Ltd | 0.4 | RBLBANK | Financials |

Bank Nifty is one of the sectoral index from NSE. Bank Nifty Index comprises of the most liquid and large Indian Banking stocks. The Index comprises of a maximum of 12 companies listed on the National Stock Exchange of India (NSE).

Both are Indices from NSE. The Nifty is the Main Index from NSE which reflects the Indian Economy and it contains the most liquid stocks. The Bank Nifty is the Sectoral index which contains only banking stocks.

Yes You can buy Nifty Bank in future contract and rollover for long term. You can also buy ETF which is based on Bank Nifty stocks

The current Lot size of Bank Nifty is 20

Read more about Top Private banks in India

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. Companies must rank within the top 800 based on both average daily turnover and average daily full market capitalization for the last six months.

ii. Companies should form a part of the Banking sector.

iii. The company’s trading frequency should be at least 90% in the last six months.

iv. The company should have a listing history of 6 months. A company that comes out with an IPO will be eligible for inclusion in the index if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

v. Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index.

vi. The final selection of 12 companies shall be done based on the free-float market capitalization of the companies.

vii. Weightage of each stock in the index is be calculated based on its free-float market capitalization such that no single stock shall be more than 34% and weightage of the top 3 stocks cumulatively shall not be more than 63% at the time of rebalancing.

Yakub

khalifa