Financial Services Industry in India Financial services form the backbone of a country’s economic growth and development. India has a diversified financial sector and undergoing rapid expansion led by various factors including policy support, improving business fundamentals, product and services innovation and target to severe underpenetrated areas.

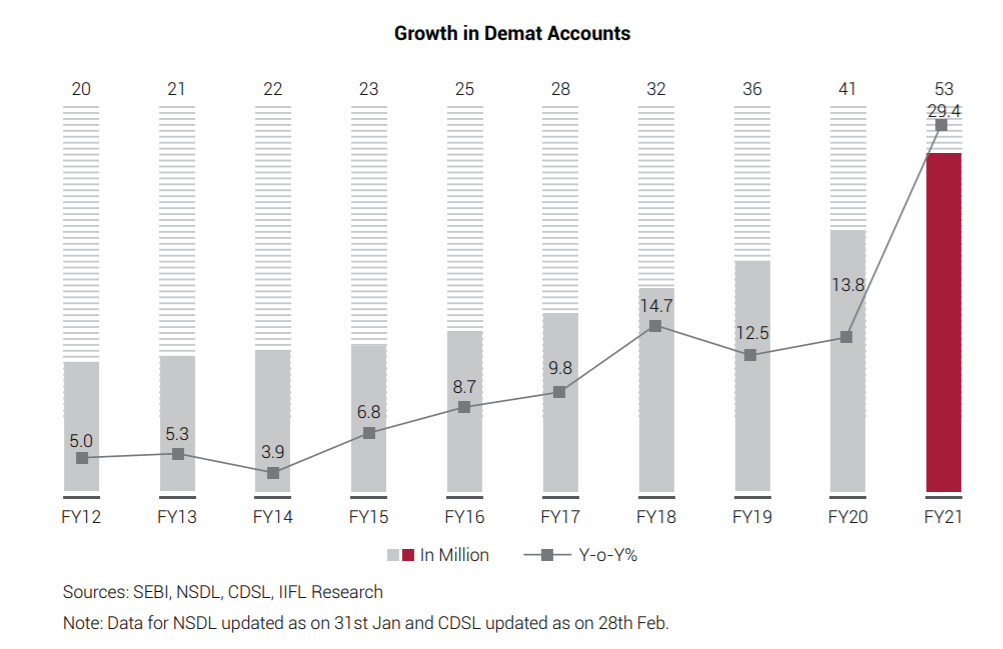

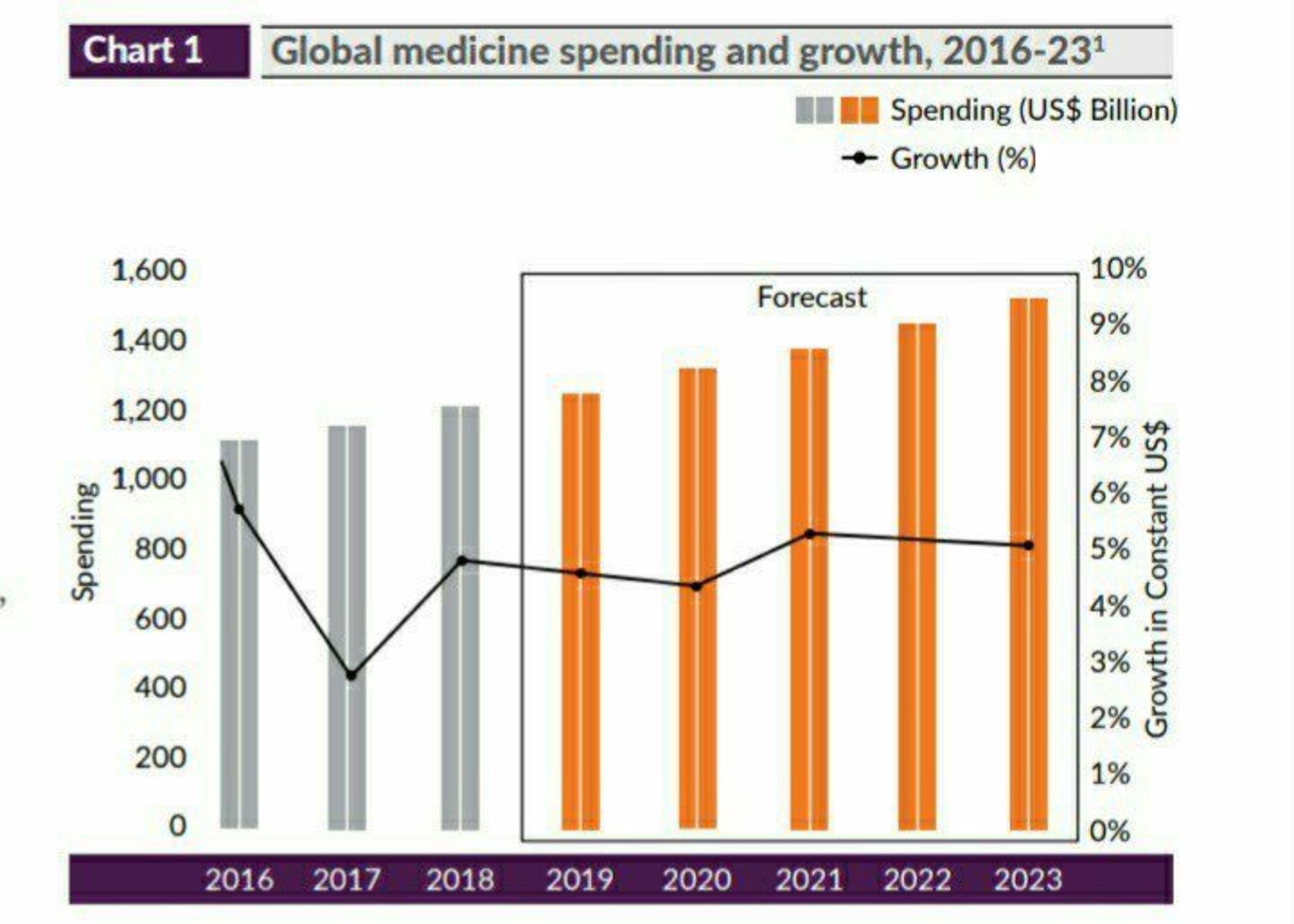

Credit off-take has been surging ahead over the past decade, supported by strong economic growth, rising disposable incomes, increasing consumerism and easier access to credit.

Financial Services Industry in India

Financial services in India is made up of commercial banks, insurance companies, non-banking financial corporations (NBFCs), cooperatives, pension funds, mutual funds and other smaller financial institutions. The banking regulator has recently allowed new entities to be formed, such as payment banks, small finance banks etc. thereby adding to the form of entities operating in the sector.

However, the sector of financial services in India is primarily the banking sector, and non-banking financial companies, with commercial banks responsible for more than 64% of the total assets held by the financial system.

The bank deposits surged by 11.4% to ₹ 151.13 lakh crore in FY 2020-21, as against 7.9% growth in the previous year despite the decline in interest rate by over a 100 basis points.

However, due to sluggish corporate investments, bank credit grew 5.6% to ₹109.51 lakh crore in FY 2020-21 as against 6.1% growth registered in FY 2019-20. Among major sectors, credit to agricultural sector grew significantly – the highest since April 2017 Credit growth to the services sector also remained strong.

Financial Services Industry in India, Credit to the industrial sector, however, contracted marginally, mainly due to a decline in credit to large industries.

NBFCs in India

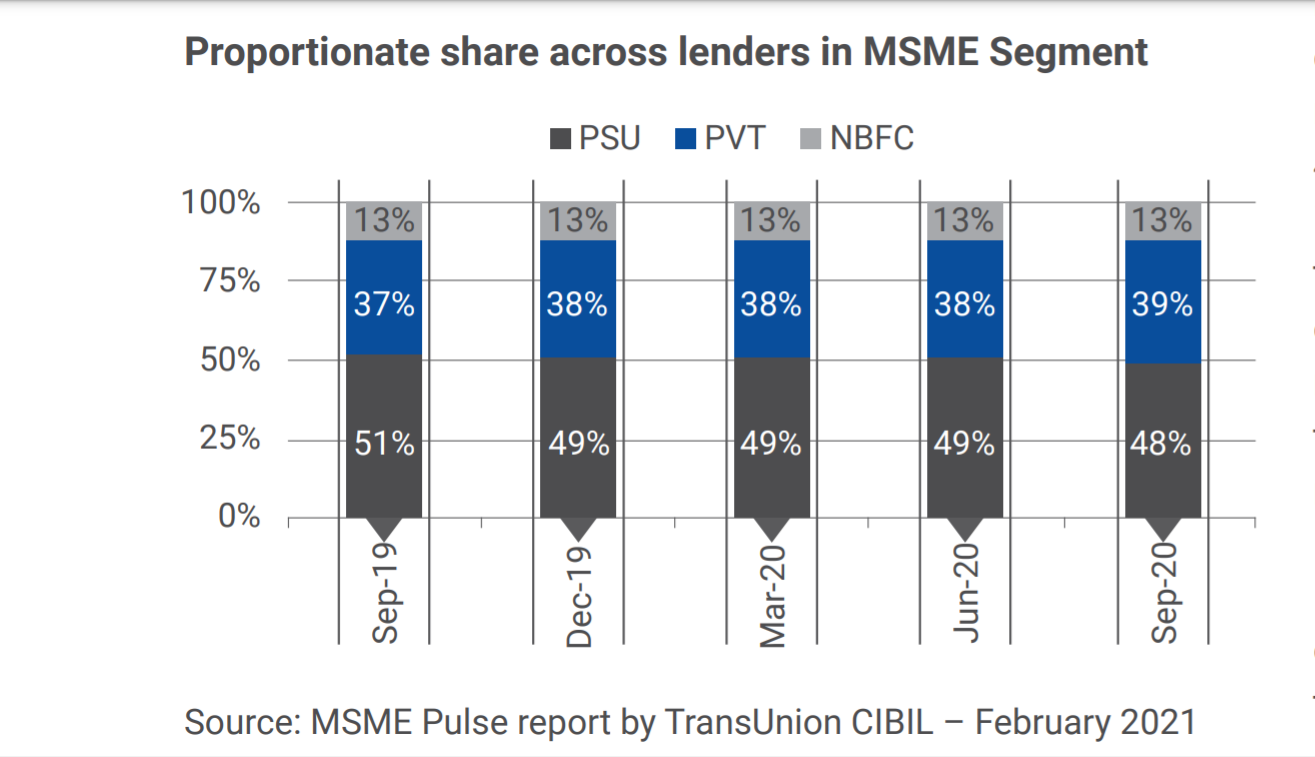

NBFCs play a critical role in financial intermediation and promoting inclusive growth by providing last-mile access of financial services to meet the diversified financial needs of under-banked customers. NBFCs also provides credit to the micro, small and medium enterprises (MSME) segment and contributes to financial inclusion.

There were 9,507 NBFCs registered with the Reserve Bank of India as on January 31, 2021. During FY 2019-20, the NBFC sector faced headwinds in the aftermath of the payment default crisis in the form of erosion of confidence among investors, rating downgrades and liquidity stress compounded by the COVID-19 pandemic.

RBI continued to take sequential regulatory measures to improve access of sufficient liquidity to the NBFC sector. On an overall basis, NBFCs were taking remedial actions including increasing provisions, correcting Asset Liability Management (ALM) profiles, decreasing leverage, etc.

Consequently, the consolidated balance sheet of NBFCs gained traction in first half of FY 2020-21 after witnessing a deceleration in FY 2019-20 due to stagnant growth in loans and advances.

After September 2020, collections inched closer to pre-COVID levels and growth gathered momentum. But the second wave of COVID-19 has pulled back some of the recovery gains with subsequent impact on asset quality.

Asset quality metrics across the sector will remain supported in FY 2020-21 by the RBI’s restructuring schemes, moratorium announced from March’20 to August’20 and economy revival post September 2020.

Financial Services Industry in India For FY 2021-22, CARE Ratings expects some level of stress, especially in the loan portfolio under restructuring and those which were under moratorium with the impact of these likely to be visible in the next one year.

As such, delinquencies are estimated to rise moderately. Moreover, GDP growth is expected at 9.5% and this time around lockdowns so far have been less stringent as compared to last year. Also, businesses in sectors such as construction, mining, infrastructure etc. continue to operate, which will aid growth the credit offtake.

Growth Drivers for NBFCs:

- Customised product offerings

- Leveraging Technology for improved efficiency and enhanced experience

- NBFCs have been tying up with multiple alternative lenders with digital platforms and commercial banks as well, which has been adding to their targeted customer base

- Ensuring enhanced governance through a proactive, robust and agile risk management model

- Introduction of scale-based regulatory framework for NBFCs by RBI. Regulations for most large NBFCs (excluding HFCs) would now be similar to banks with some modifications factoring heterogeneity/target segment

- Higher loan-to-value as NBFCs offer higher amounts of loan against security as compared to banks

- Lower turnaround time as NBFCs are able to meet immediate funding requirements with faster loan processing systems

![Finance Company in India [List]](https://indiancompanies.in/wp-content/uploads/2020/07/Finance-Company-in-India-List.png)

Hi thanks for this amazing article pls keep posting and sharing blog like this