HDFC AMC [ Asset Management Company Limited ] is India’s most worthwhile mutual fund Firm, main in actively managed equity-oriented assets under management (AUM). It is without doubt one of the Largest AMC in India.

The Firm Has clients and distribution companions in over 200 cities by way of community of 221 branches and 1,194 staff.

The only most necessary issue that drives HDFC Mutual Fund is its perception to present the investor the prospect to profitably spend money on the monetary market, with out always worrying in regards to the market swings.

HDFC AMC [Asset Management Company] Limited

HDFC asset management company limited was Began in 1999, arrange as a three way partnership between Housing Development Finance Corporation Limited (“HDFC”) and Standard Life Investments Limited (“SLI”).

- Equity-oriented – 23 SCHEMES

- Debt-oriented – 90 SCHEMES

- Liquid – 2 SCHEMES

- Others – 7 SCHEMES

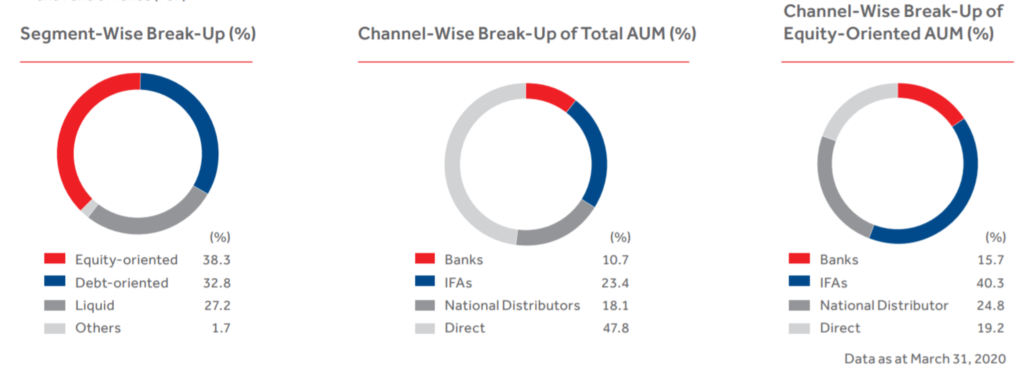

HDFC asset management firm limited total Mutual Fund AUM (as on March 31, 2020) of Rs 3.9 Lakh Crore spans throughout a complete suite of funding merchandise throughout asset courses and scheme classes to satisfy the varied funding goals of huge buyer base of 56 Lakh people and establishments.

HDFC AMC has turned a publicly listed firm in August 2018. Presently, 26.1% of the corporate is owned by the general public. HDFC Asset Management Company (“HDFC AMC”) is the funding supervisor to the schemes of HDFC Mutual Fund (“HDFC MF”).

- Equity-oriented schemes constituted 38% of our total AUM.

- Fixed income schemes constituted 60% of our total AUM

- Mutual Fund Assets Under Management (AUM): ₹3,95,476 Cr

HDFC asset management company limited serve clients and distribution companions in over 200 cities by way of community of investor service centres and trendy digital platforms. The Firm additionally present portfolio administration and individually managed account companies. These companies cater to

- High net worth individuals (HNIs),

- family offices,

- domestic corporates,

- trusts,

- provident funds and

- domestic and global institutions

HDFC asset management firm limited supply a complete suite of financial savings and funding merchandise throughout asset courses, which offer revenue and wealth creation alternatives to massive retail and institutional buyer base of 9.4 million reside accounts. HDFC AMC has a dominant place in fairness investments, with the very best market share in actively managed equity-oriented funds.

The AMC has a dominant place in fairness investments, with the very best market share in actively managed equity-oriented funds. The Firm strengths lie in delivering easy and accessible funding merchandise for the common Indian family and are probably the most most popular alternative for retail traders, with the very best market share in assets from particular person traders.

Over one in 4 Indian mutual fund traders have invested in not less than certainly one of schemes. The Firm providing of systematic transactions additional enhances enchantment to particular person clients seeking to make investments periodically in a disciplined and risk-mitigating method.

Housing Development Finance Corporation Limited (HDFC) and Standard Life Investments Limited which own 52.7% and 26.9% stake respectively are the Promoters

HDFC AMC do funding merchandise throughout asset courses and scheme classes to satisfy the varied funding goals of huge buyer base of 56 Lakh people and establishments.

Equity-oriented Schemes are best to do SIP Manner in HDFC

HDFC AMC is one the best and the Largest AMC In India

The Firm schemes have weathered a number of market cycles and carry observe information of as much as 25 years. The Firm presently have over 65 thousand empanelled distributors which embody unbiased monetary advisors, nationwide distributors and banks.

Top Mutual fund Company in India

HDFC AMC Promoter

Housing Development Finance Corporation Limited (HDFC) and Standard Life Investments Limited which own 52.7% and 26.9% stake (as on March 31, 2020), respectively.

Managing Director Milind Barve

Mr. Milind Barve [DIN 00087839] is the Managing Director of the Firm since July 4, 2000. He has a Bachelor’s diploma in Commerce from the College of Poona and

he’s additionally a fellow of the Institute of Chartered Accountants of India.

He was related to HDFC within the capability of Common Supervisor – Treasury, the place he headed the treasury operations for 14 years and was liable for the

administration of HDFC’s treasury portfolio and for elevating funds from monetary establishments and capital markets.

He was additionally the top of promoting for retail deposit merchandise and liable for funding advisory relationships for Commonwealth Fairness Fund Mutual Fund and Invesco India Progress Fund.

Thank you kindly for these helpful advices, I will be searching forward for more data and I might want to impart this articles to my loved ones and will tell you about their surveys.

Which is the best mutual fund of HDFC?

Who is the CEO of HDFC Mutual Fund?