According to the FICCI-EY Report 2019, (the Report), the Media and Entertainment Industry in India grew by 13.4% YoY in CY18, to Rs 1,67,400 Crore. India is witnessing a significant increase in content consumption due to an increase in availability and improvement in affordability.

Be it the growing number of mobile and television sets, improving multiplex penetration or smaller cities getting their own radio stations, availability of content is improving across platforms and is expected to get better going ahead.

Media and Entertainment Industry in India

However, India’s per capita entertainment consumption is still lower than most of its peers, representing significant room for sustained growth which would be driven by rising disposable incomes and increasing access to content.

Future of media and entertainment industry in India

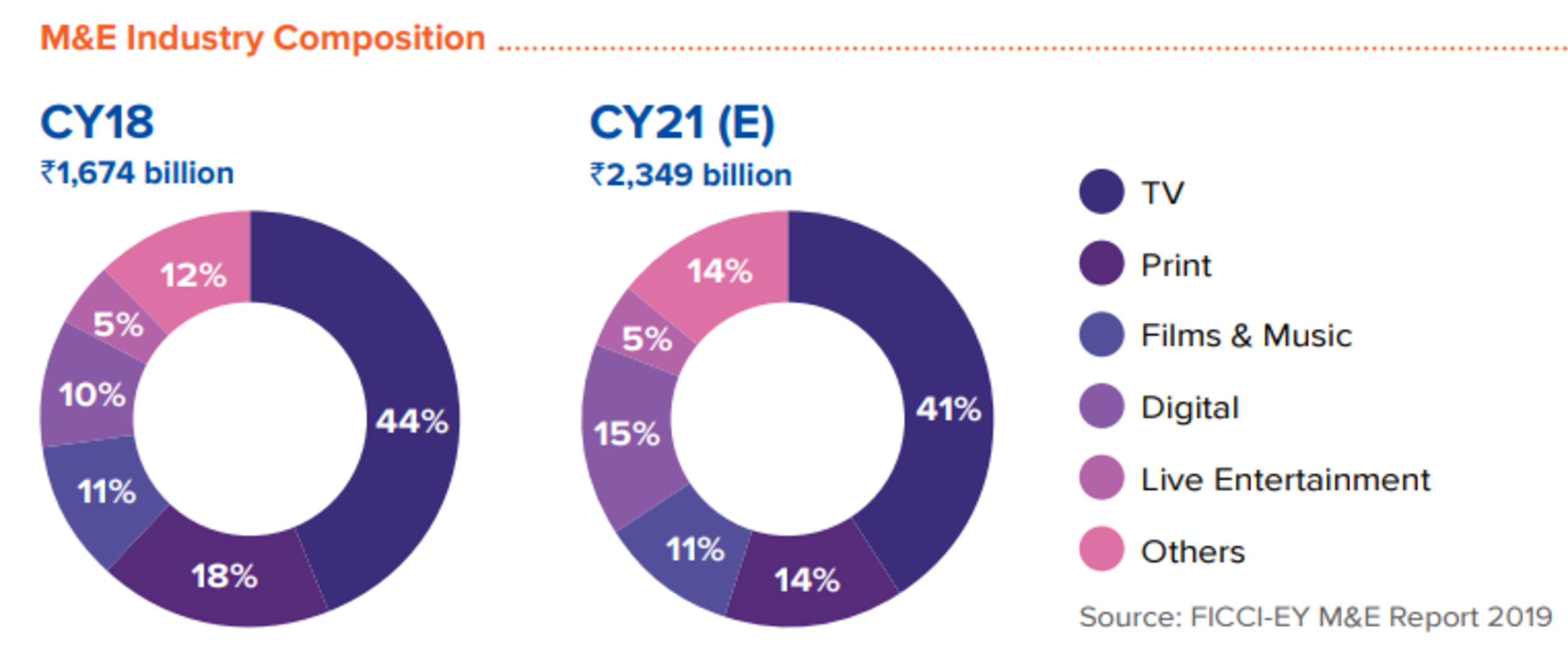

The following chart describes Media and Entertainment Industry Composition in India

According to the report, the Indian Media and Entertainment Industry is expected to grow at a CAGR of 12.0% to Rs 2,34,900 Crore over the next three years, with growth in all the segments.

During the year 2020, television increased its reach and engagement with the audience, retaining its position as the default entertainment medium for Indian consumers. Growth in online video consumption accelerated, helped by the increased availability of affordable data and content on digital platforms.

Print media continued to grow, albeit at a much slower pace. The movie industry surpassed all the previous box-office records on the back of strong performances in both domestic and international markets. Radio, in addition to entering new cities, is diversifying into new business offerings like concerts and activations. Growth in live events was led by premium properties, sports events, and digital integration.

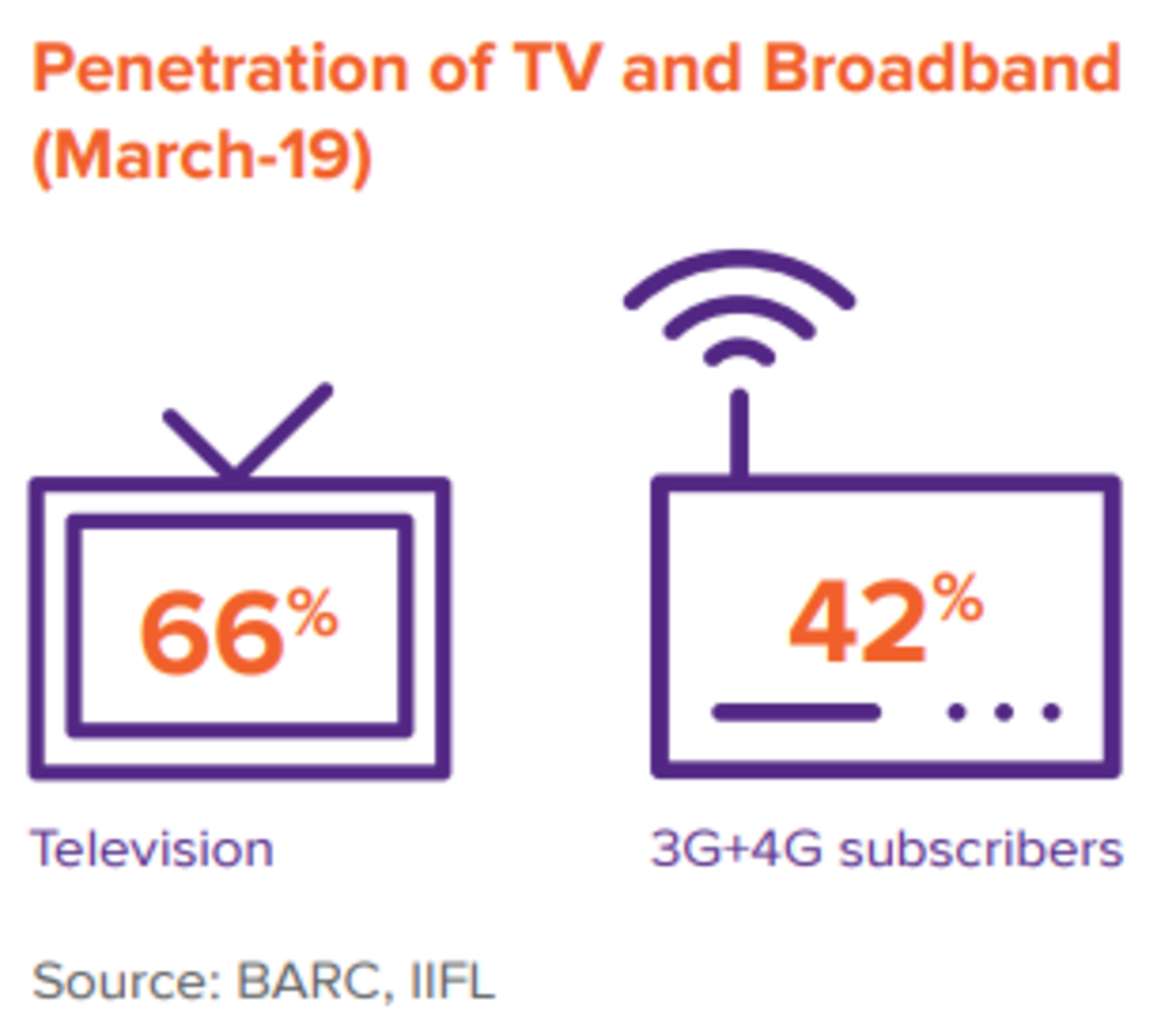

TV and SmartPhone Penetration

India’s device penetration is low. With 66% TV penetration and 35% smartphone penetration, a large population has not even started consuming content on a regular basis. As income levels in India increase and prices of these devices fall, penetration will improve, leading to higher content consumption.

Digital also makes it possible to consume content anywhere and anytime. As such, it is taking away time from other activities like reading or making it possible to consume content while traveling. Separately, increasing power availability in small towns and rural India is giving a boost to television viewership.

Advertising Spends in India [ Media and Entertainment Industry in India ]

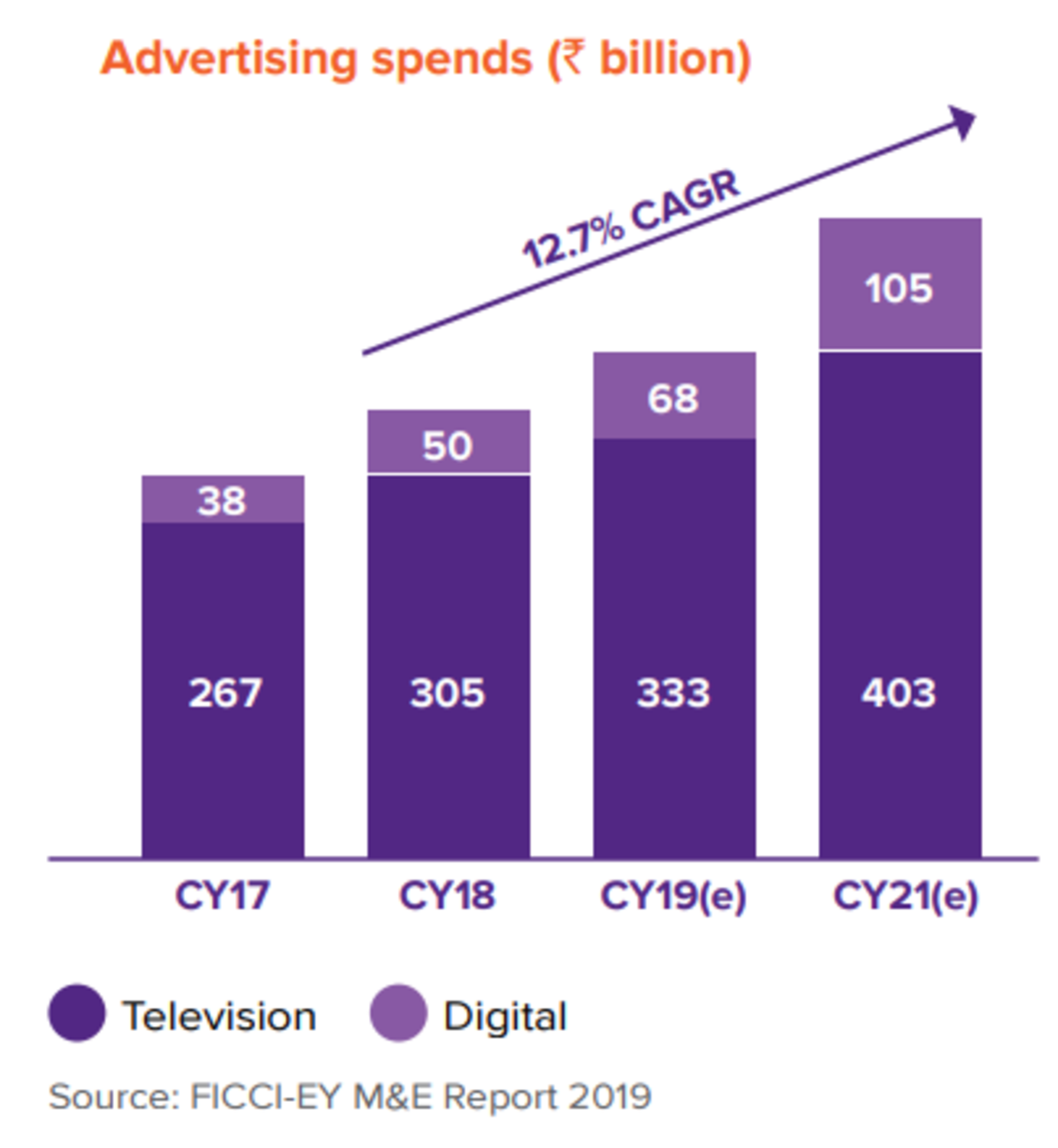

India’s advertising spends grew by 13% in CY18 and as per the Report, it is expected to grow at a CAGR of 11.4% over the next 3 years.

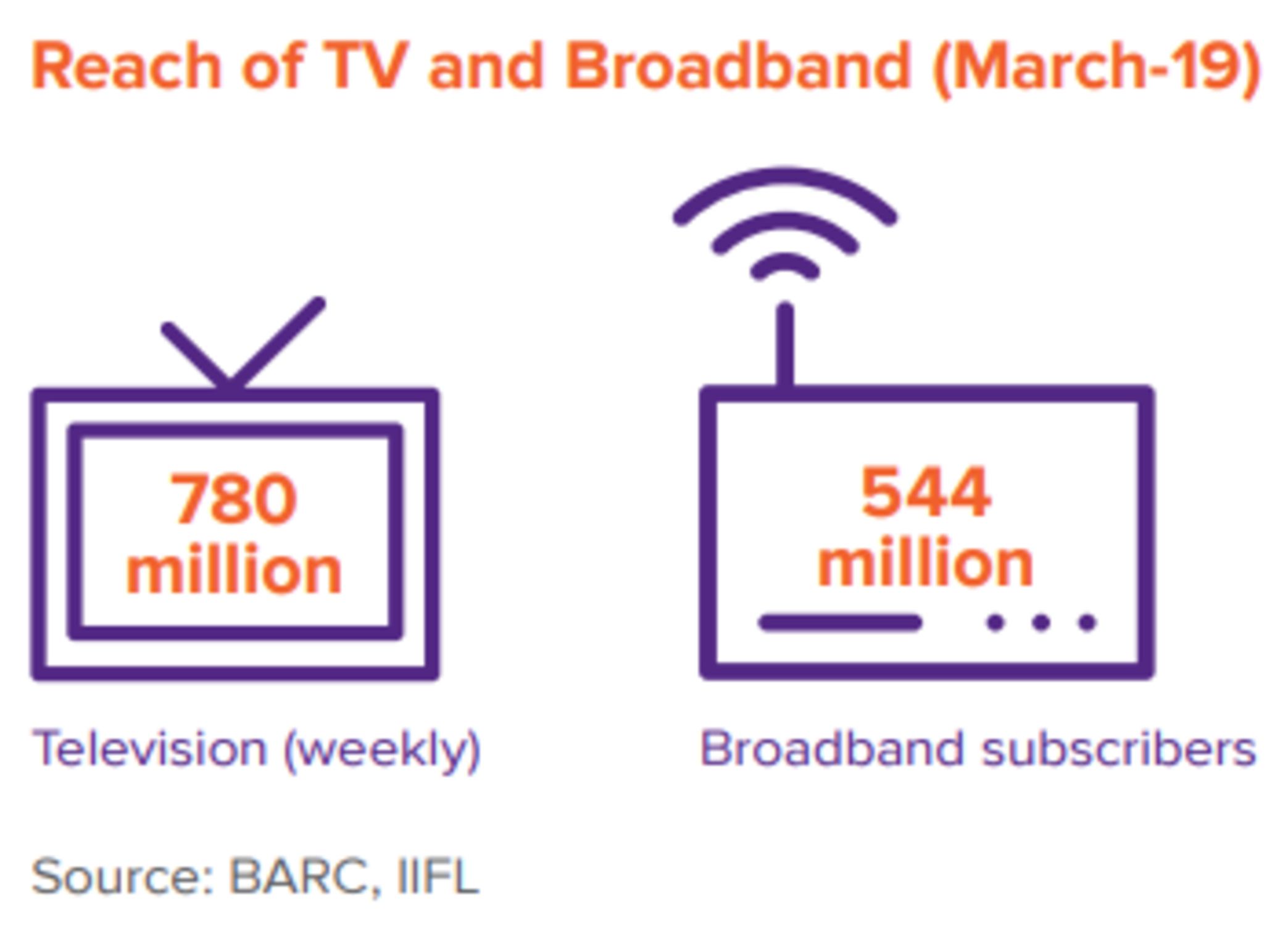

Television and digital offer different propositions to advertisers. Television’s high engagement levels and a weekly reach of 780 million individuals making it the default medium for reaching out to a large consumer base. This makes television the preferred media for brand-building.

On the other hand, digital’s ability to target consumers based on their profile and interests is more suited for a certain set of brands and transaction-based advertising. Digital also enables small enterprises to advertise, thereby expanding the advertiser base significantly.

It is estimated that over 300,000 businesses advertised on digital as compared to 12,000 advertisers on television and 180,000 on print. Advertisers are leveraging the power of both the mediums together to meet their marketing objectives.

As per the Report, in CY18 the television industry grew by 12% to Rs 74,000 Crore.

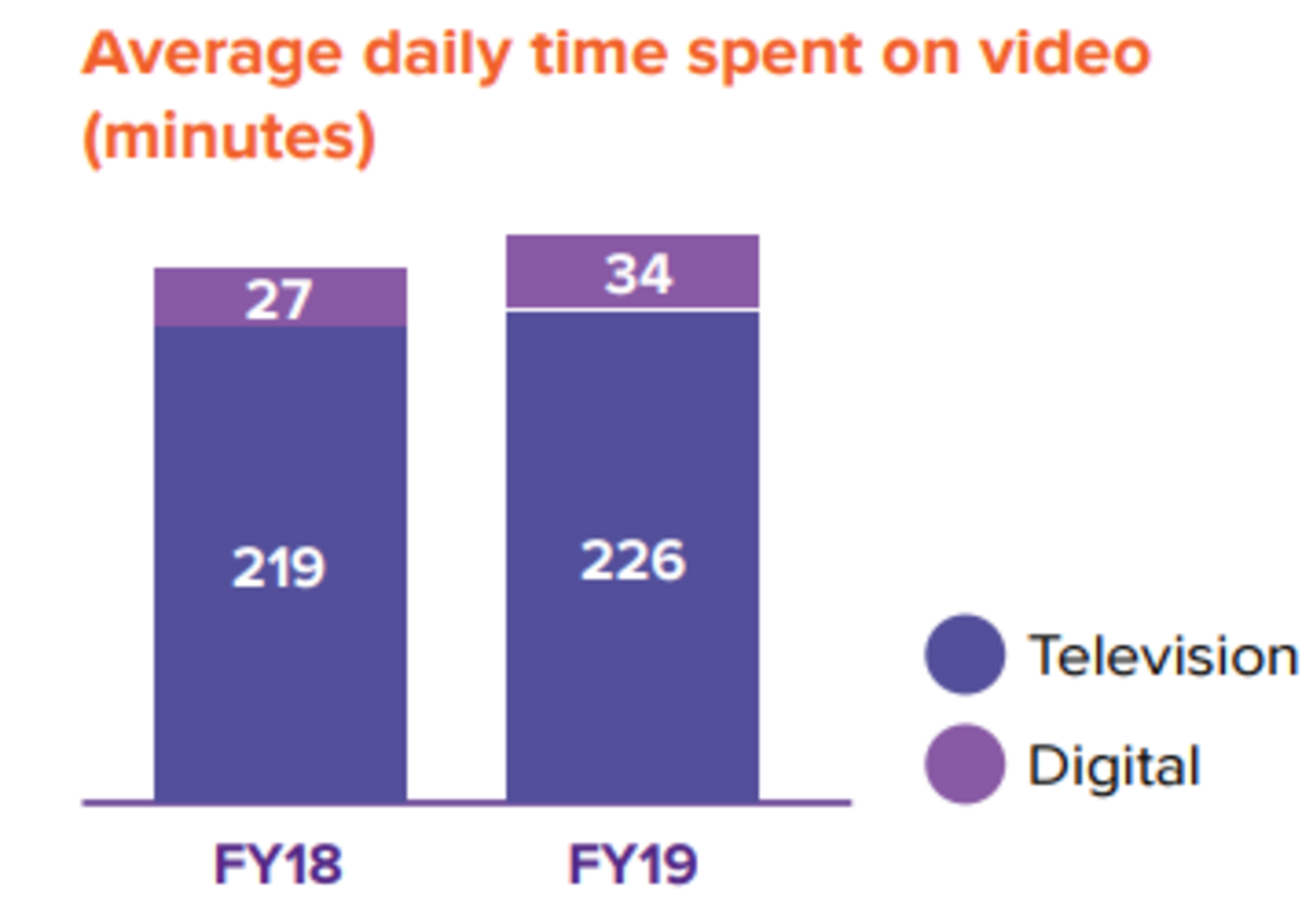

Time spent on Television in India

Television in India remains by far the most popular medium for entertainment in terms of reach and engagement.

During 2018, it reached 780 million viewers on a weekly basis with an average daily time-spent of 226 minutes per individual. Continuous innovation, more content and new formats are driving up the engagement levels.

In the year gone by, the television universe added 56 million viewers and the time-spend registered a marginal growth. More importantly, time-spend on television is on a growth trajectory across all age-groups, geographies, socio-economic classes, and gender.

With a viewership of 989 billion man-minutes a week, TV continues to lead video consumption with a 93% share.

Indian Movie and Music Industry

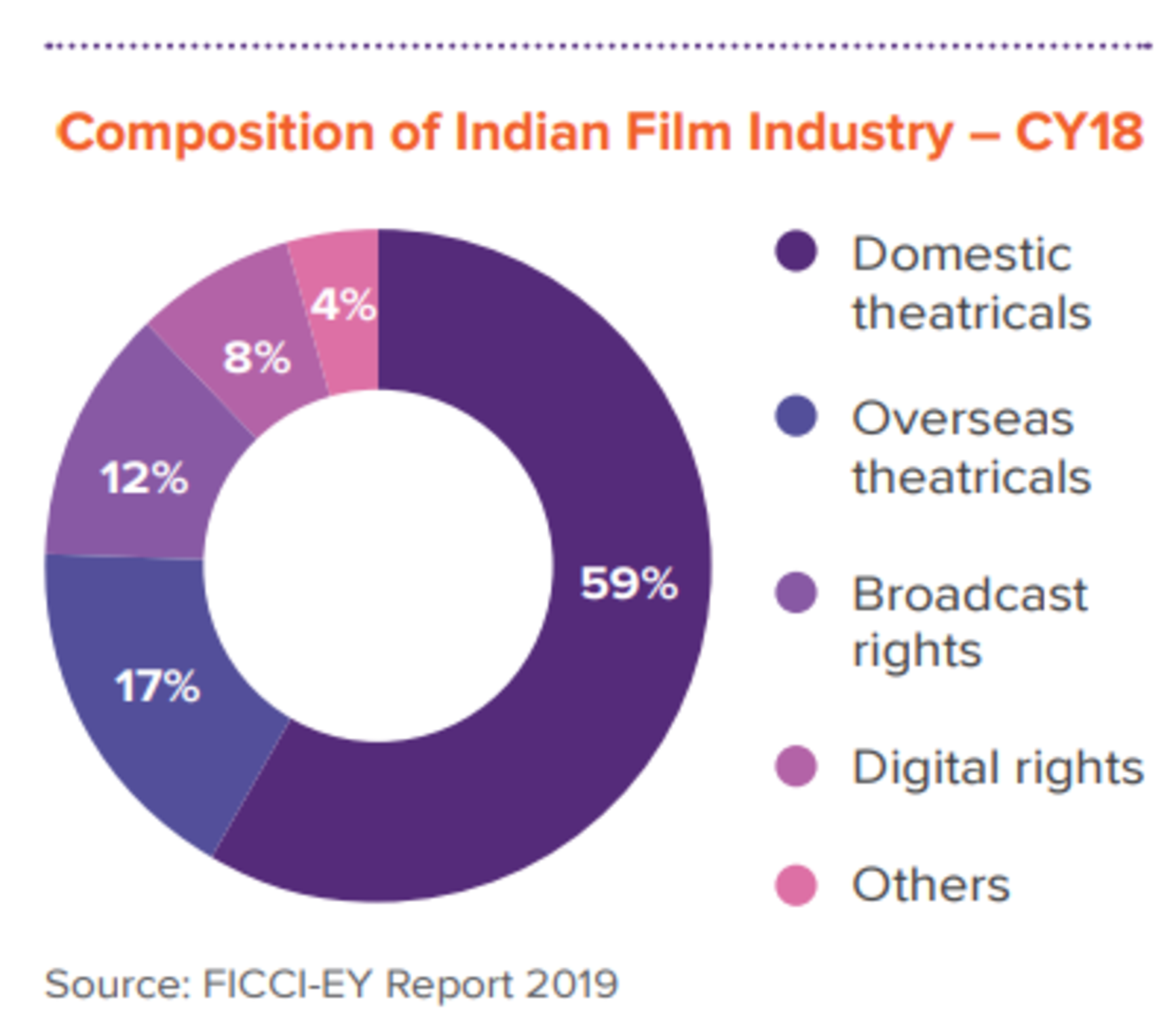

In 2018, the Indian movie industry grew by 12.2% to Rs 17,450 Crore, driven by a 59% increase in the market for digital rights and a 20% growth in overseas theatrical revenues. The industry is estimated to grow at 11% CAGR over CY18-21 as per the Report.

In 2018, the Indian music industry grew by 11% and is expected to grow at a similar pace over the next three years to reach Rs 1920 Cr.

M&E industry grew by 13.4% YoY in CY18, to Rs 1,67,400 Crore. India is witnessing a significant increase in content consumption due to an increase in availability and improvement in affordability.

![Top Music Apps [Audio streaming] in India](https://indiancompanies.in/wp-content/uploads/2021/02/Top-Music-Apps-Audio-streaming-in-India.png)