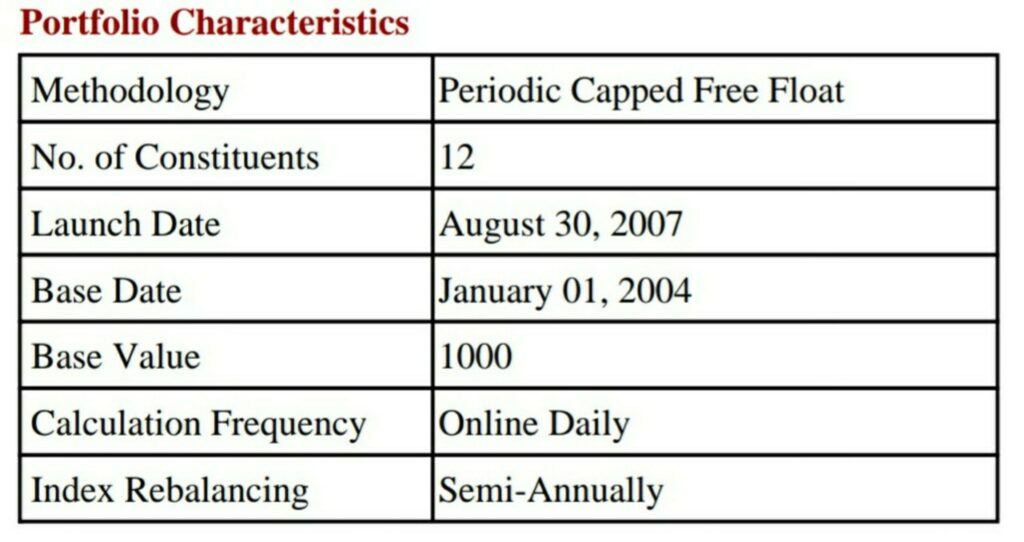

The NIFTY PSU Bank Index captures the performance of the PSU Banks. The Index comprises a of maximum 13 companies listed on the National Stock Exchange (NSE).

PSU Bank Index is computed using a free-float market capitalization method, wherein the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value. NIFTY PSU Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

NIFTY PSU Bank Index

Index is designed to reflect the behavior and performance of the public sector banks. The index comprises of a maximum of 13 stocks. The base date of the index is January 1, 2004, and the base value of 1000 points.

Nifty PSU Bank Weightage

State bank of India has the Highest weightage in Nifty PSU Bank Index followed by Bank of Baroda, Canara bank etc.

| S.No | Stock | Index weight |

| 1 | State Bank of India | 76.4 |

| 2 | Bank of Baroda Ltd | 5.6 |

| 3 | Canara Bank Ltd | 5.5 |

| 4 | Punjab National Bank | 4.8 |

| 5 | Union Bank of India Ltd | 2.1 |

List of Nifty PSU Bank Stocks

Companies must have 51% of their outstanding share capital held by the Central Government and/or State Government, directly or indirectly.

Here is the Nifty PSU Bank List

| S.No | Stock | weight % | Sector | Symbol |

| 1 | State Bank of India | 76.4 | Financials | SBIN |

| 2 | Bank of Baroda Ltd | 5.6 | Financials | BANKBARODA |

| 3 | Canara Bank Ltd | 5.5 | Financials | CANBK |

| 4 | Punjab National Bank | 4.8 | Financials | PNB |

| 5 | Union Bank of India Ltd | 2.1 | Financials | UNIONBANK |

| 6 | Bank of India Ltd | 1.7 | Financials | BANKINDIA |

| 7 | Indian Bank | 1.4 | Financials | INDIANB |

| 8 | Indian Overseas Bank | 0.6 | Financials | IOB |

| 9 | Central Bank of India Ltd | 0.5 | Financials | CENTRALBK |

| 10 | Bank of Maharashtra Ltd | 0.5 | Financials | MAHABANK |

| 11 | Jammu and Kashmir Bank Ltd | 0.4 | Financials | J&KBANK |

| 12 | UCO Bank | 0.3 | Financials | UCOBANK |

| 13 | Punjab & Sind Bank | 0.1 | Financials | PSB |

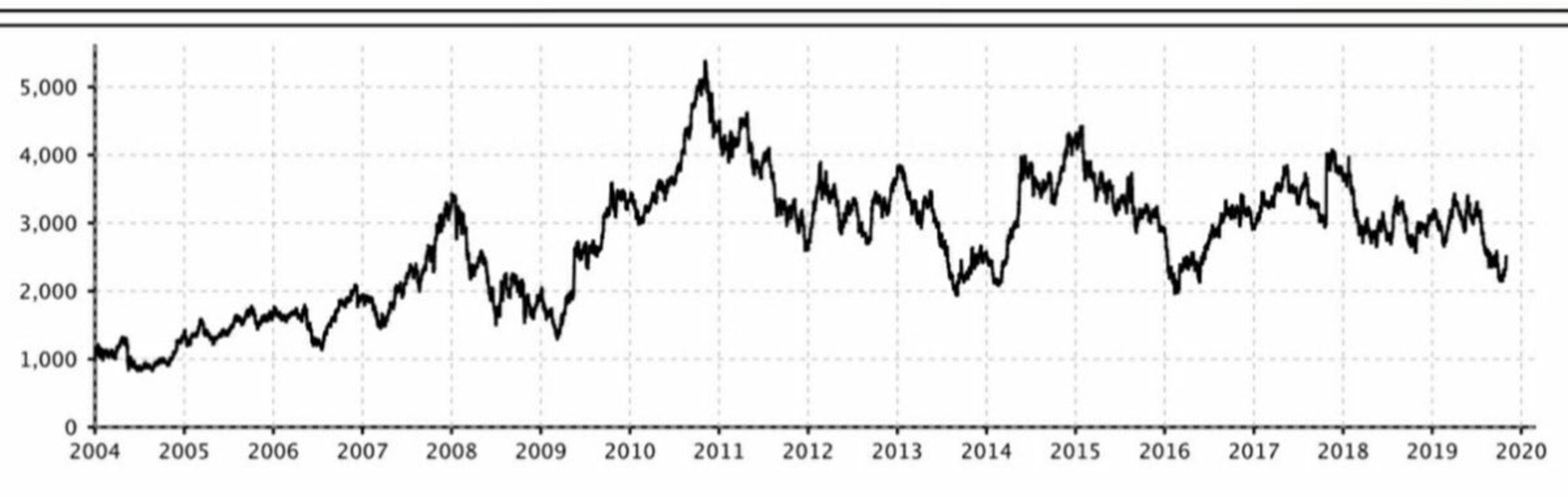

Nifty PSU Bank Chart

Since Inception Nifty PSU Bank Index has given a total return of 7% CAGR for the last 16 years. Here is the chart from 2004 to 2020

ETF for Nifty PSU Bank Index

List of Nifty PSU Bank ETF Tracking PSU Bank Index with Expense Ratio in Percentage.

- Nippon India Nifty PSU Bank Bees ETF (PSUBNKBEES) – Expense Ratio: 0.49%

- Kotak Nifty PSU Bank ETF (KOTAKPSUBK) – Expense Ratio: 0.49%

Other sectors Index

The NIFTY Pharma Index is designed to reflect the behavior and performance of the companies that are engaged in the manufacturing of pharmaceuticals. The index comprises of a maximum of 10 stocks. The base date of the index is January 1, 2001, and the base value of 1000 points.