ICICI Securities Ltd is an integrated technology-based securities firm offering a wide range of services including retail and institutional broking, financial products distribution, private wealth management, and issuer and advisory services.

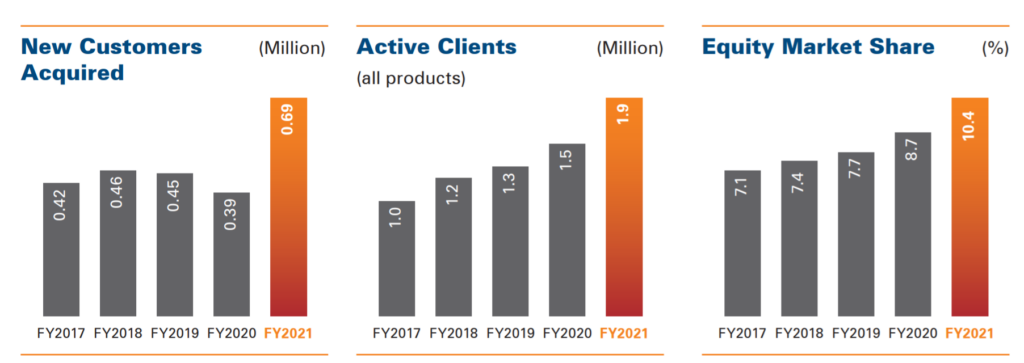

The Company is amongst the leading equity house in the country with ~5.4 Million customers and total client assets worth ₹ 3.8 Lakh Crore (assets of clients including equity demat assets maintained with ICICI Bank Limited and excluding promoter holding).

ICICI Securities Ltd is incorporated and domiciled in India. The equity shares of the Company are listed. The address of the Registered Office is ICICI Centre, H. T. Parekh Marg, Churchgate, Mumbai – 400020.

Profile of ICICI Securities Limited

ICICI Securities Limited incorporated in March 09, 1995, is a public company engaged in

the business of broking (institutional and retail), distribution of financial products, merchant banking and advisory services.

ICICI Securities Limited is a leading technology-based securities firm in India operating across capital market segments including retail and institutional equity, financial product distribution, private wealth management and investment banking.

It is one of the pioneers in the e-brokerage business in India. ICICI Securities operates www.icicidirect.com, India’s leading virtual financial supermarket, meeting the three need sets of its clients – investments, protection, and borrowing.

Headquartered in Mumbai, the Company operates out of ~70 cities in India and wholly-owned subsidiary in US and its branch in Singapore.

The company endeavour to become a comprehensive fintech solutions provider to life cycle investment, protection and borrowing needs of retail Indians in a digital and open architecture format.

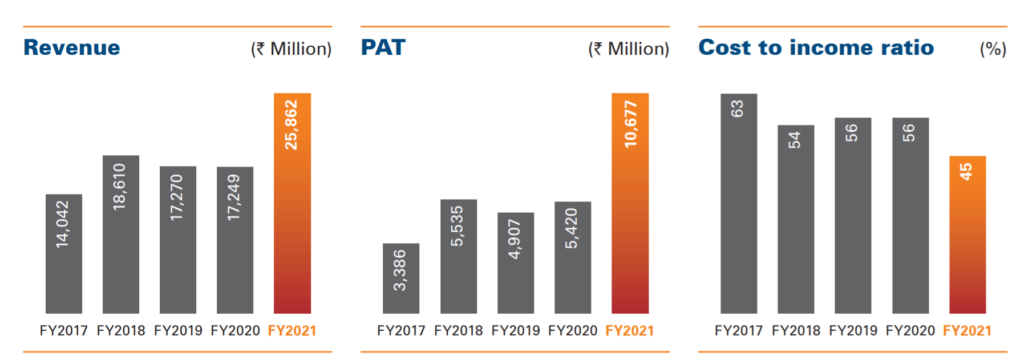

- Revenue: ₹ 2586 Cr

- Presence through partners: 18,400+

- Employees: 3,200

The company is well placed as a leading name in the industry driven by end-to-end technology platforms, experienced management, diversified product portfolio and supported by physical presence at strategic locations to support the digital business.

ICICI Securities is one of the leading brakeage company and also assists its customers like retail investors, corporates, financial institutions, High Net Worth Individuals (HNI) and Ultra HNIs in meeting their financial goals by providing them with research, advisory and execution services.

ICICI Securities operates www.icicidirect.com. Icici direct is one of the pioneers in the e-brokerage business in India.

Yes, ICICI securities is one of leading stock broker in India based on the number of customers and it operates through ICICI Direct.

ICICI Direct Leading stock Broker

ICICI Securities Ltd operates www.icicidirect.com, India’s leading virtual financial supermarket, meeting the three need sets of its clients – investments, protection and borrowing. The Company assists its customers like retail investors, corporates, financial institutions, High Net Worth Individuals (HNI) and Ultra HNIs in meeting their financial goals by providing them with research, advisory and execution services.

One of the largest equity franchise

- 5.4 Mn Client base

- ₹ 3.8 Tn Total assets

- 1.91 Mn Overall active clients

Products and services

Through its four lines of businesses — broking, distribution of financial products, wealth management, and investment banking– I-Sec serves customers ranging from the retail and institutional investors to corporates to high net-worth individuals to government.

I-Sec is registered with the Securities and Exchange Board of India (SEBI) as a Stock Broker, Merchant Banker, Portfolio Manager, Investment Adviser and Research Analyst.

It is also registered as Corporate Agent with the Insurance Regulatory and Development Authority of India (IRDAI) and Point of Presence (POP) with the Pension Fund Regulatory and Development Authority of India (PFRDA) for distribution of National Pension Scheme (NPS).

Retail equity

Offer all investment and trading solutions across asset classes to retail investors through comprehensive platform and a bouquet of digital properties.

- Distribution Revenue: ₹ 15,98 Cr

Investment and trading across asset classes including equity, commodity, derivatives,

currency, margin trading funding, offshore investments etc.

Distribution of financial products

ICICI Direct service the wide client base with a bouquet of proprietary as well as third party products designed for varied life stage needs. The company omni-channel model which is a combination of platform and platform assisted approaches, offers a hyper personalised experience to clients.

- ₹ 4,28 Cr

Mutual Fund, Gold Bonds, ETFs (Exchange Traded Funds), NPS (National Pension

Scheme), Corporate FDs (Fixed Deposits) and Bonds, Insurance (Life, General and

Business), Credit (Home Loans, Loan against Securities / Property / FD / Bonds / MF),

Rental Discounting, Asset Financing and Overdraft

Private wealth management

Service High Networth clients by providing innovative products and solutions across

their investment, businessand allied needs

- Total AUM: ₹ 1,68,076 Cr

Investment solutions like Equity, Fixed Income, Offshore and Alternate Investments; value-added services like Protection, Mortgages & Loans, Tax Advisory and Estate Planning

Engagement with customers on business needs like raising equity capital, debt syndication and monetising assets.

Institutional equity

Offers domestic and international institutional clients brokerage services and is empanelled with a large cross section of institutional clients. The company also work with trade aggregators.

ICICI Direct also provide solutions like block deals, which provide liquidity and enable them to trade on Indian stock exchanges as per their specific requirements.

Equity brokerage service for domestic and international institutional clients Value-added products and services, including Block Deal, Algo Trading, Corporate Access, Investor Meets, and Equity Research.

Issuer and advisory services

Services include M&A advisory, structured products, private equity, restructuring advisory etc. across US, Europe, Asia and India.

Full-service investment bank providing services including, Equity Capital Market, Debt Advisory, Mergers & Acquisitions, Advisory, Private Equity Services, Structured Products and Restructuring.

Subsidiary of ICICI Securities

ICICI Securities Ltd has a 100% owned subsidiary ICICI Securities Holdings, Inc. and a step-down subsidiary ICICI Securities Inc.

ICICI Securities Holding, Inc. is the holding company of indirect subsidiary ICICI Securities Inc., which through its offices in US and Singapore, is engaged in referring foreign institutional clients for transactions on the Indian stock exchanges.