The origin of the State Bank of India Limited goes back to the first decade of the nineteenth century with the establishment of the Bank of Calcutta in Calcutta on 2 June 1806. Three years later the bank received its charter and was re-designed as the Bank of Bengal (2 January 1809).

Profile of State Bank of India [ SBI ]

With a legacy of over 200 years, State Bank of India is an Indian multinational, public sector banking and financial services statutory body. For SBI, the interests of the common man have always remained at the core of its business.

The Bank has a strong portfolio of distinctive products & services, and leverages technology to deliver and manage them in a personalised and customer centric way.

Headquartered in Mumbai, SBI provides a wide range of products and services to individuals, commercial enterprises, large corporates, public bodies, and institutional customers through its various branches and outlets, joint ventures, subsidiaries, and associate companies.

It has always been in the forefront to embrace changes without losing sight of its values such as Service, Transparency, Ethics, Politeness and Sustainability

A unique institution, it was the first joint-stock bank of British India sponsored by the Government of Bengal. The Bank of Bombay (15 April 1840) and the Bank of Madras (1 July 1843) followed the Bank of Bengal. These three banks remained at the apex of modern banking in India till their amalgamation as the Imperial Bank of India on 27 January 1921.

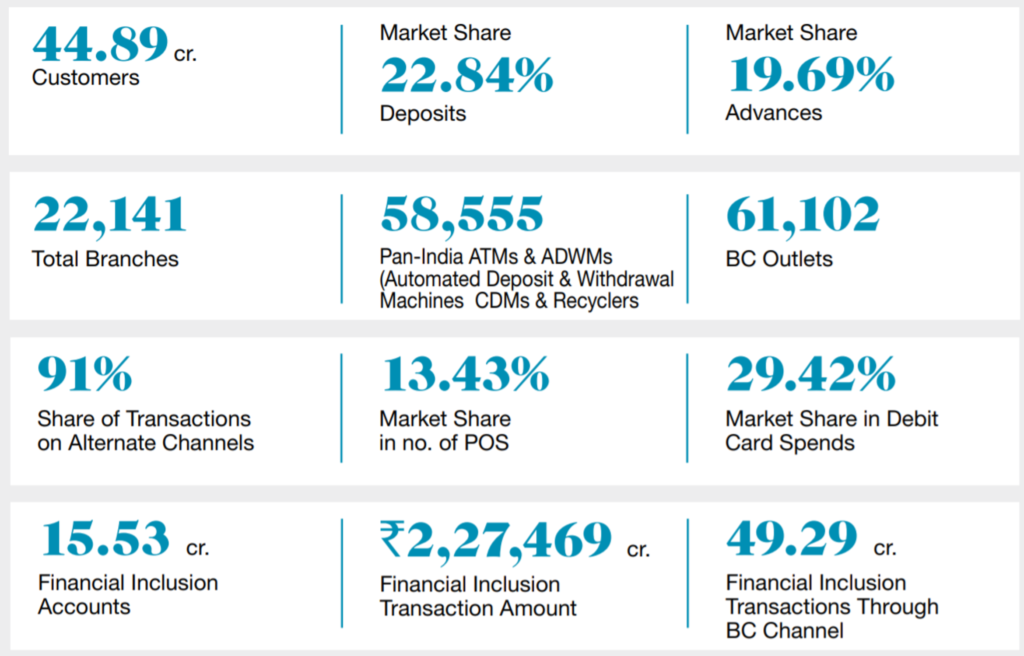

- 22,141 Total Branches

- 61,102 BC Outlets

- 58,555 Pan-India ATMs & ADWMs (Automated Deposit & Withdrawal Machines CDMs & Recyclers

- 29.42% Market Share in Debit Card Spends

State Bank of India Limited With a legacy of over 200 years, State Bank of India is an Indian multinational, public sector banking and financial services statutory body. Headquartered in Mumbai, SBI provides a wide range of products and services to

- Individuals,

- Commercial enterprises,

- Large Corporates,

- Public bodies, and

- Institutional customers

through its various branches and outlets, joint ventures, subsidiaries, and associate

companies. It is one of the largest ATM Networks in the world, with 58,555 ATMs, including Automated Deposit and Withdrawal Machines (ADWMs) as on 31st March, 2020. In order to provide 24×7 cash deposit and withdrawal facility, it has installed 13,270 ADWMs.

- 12.05 crore PMJDY accounts opened by SBI

- 11.28 crore RuPay Debit Cards issued to customers

- 44.89 crore Customers

- Market Share 22.84% Deposits

- Market Share 19.69% Advances

Nearly, 28% of the financial transactions of Bank are routed through ATMs /

ADWMs. With a market share of 28.35% (as per RBI Data) in ATM Network in India,

it transacts 46.04% of the Country’s total ATM transactions.

The following are the primary segments of the Bank:-

- Treasury

- Corporate / Wholesale Banking

- Retail Banking

- Other Banking Business

Services offered by state bank of india

- Personal Banking

- SME Banking

- International Banking Group

Shri Rajnish Kumar Chairman

- M.Sc (Physics)

Rajinish Kumar is the current chairman of state bank of India. He has Experience in various verticals of Banking like Retail, Corporate Investment, International Banking, Compliance & Risk, Mid Corporate Group etc.

Shri P. K. Gupta Managing Director (Retail & Digital Banking)

- B.Com,

- Company Secretary ICSI (New Delhi)

He was heading Retail and Digital Banking. He has experience in areas of Compliance and Risk, Treasury Operations. He has been the Deputy Managing Director and Chief Financial Officer of the Bank.

Shri Dinesh Kumar Khara Managing Director (Global Banking & Subsidiaries)

- M.Com,

- MBA

He has work experience in field of commercial banking including retail credit, small and medium enterprises / corporate credit, deposit mobilization, international banking operations, branch management.

Shri Arijit Basu Managing Director (Commercial Clients Group & IT)

- BA (Economics)

- MA (History)

He has headed SBI Life Insurance Company Limited. He has experience in the field of corporate banking, international banking, retail banking and human resources and was also

part of business process re-engineering initiative undertaken by the Bank.

Shri Challa Sreenivasulu Setty Managing Director (Stressed Assets)

- B.Sc (Agri)

He has rich experience in Corporate Credit, Retail banking and banking in developed markets. Mr Setty was heading the Stressed Asset Resolution Group of the Bank. He will be looking after Retail & Digital Banking.

Top Public sector banks in India