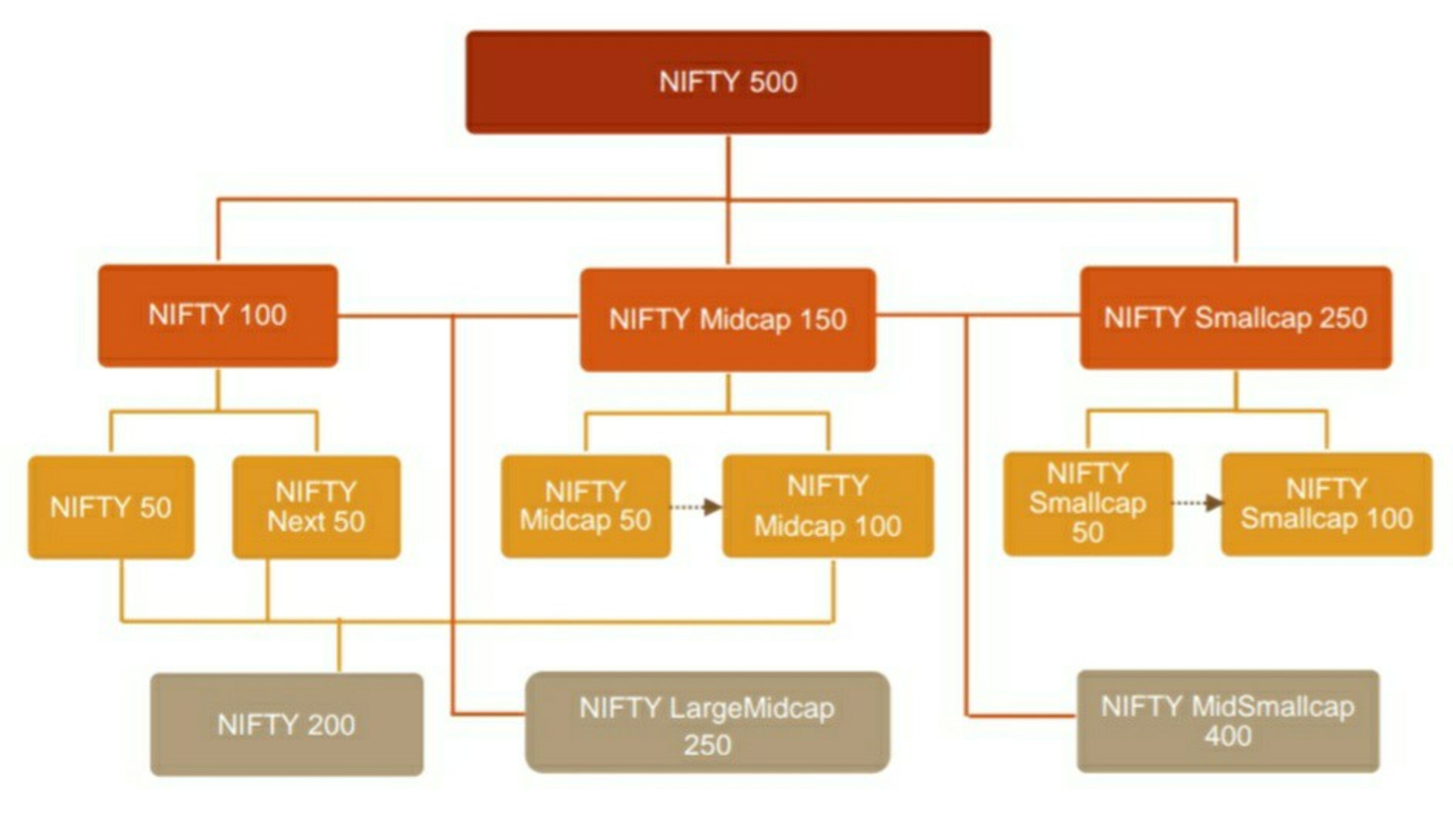

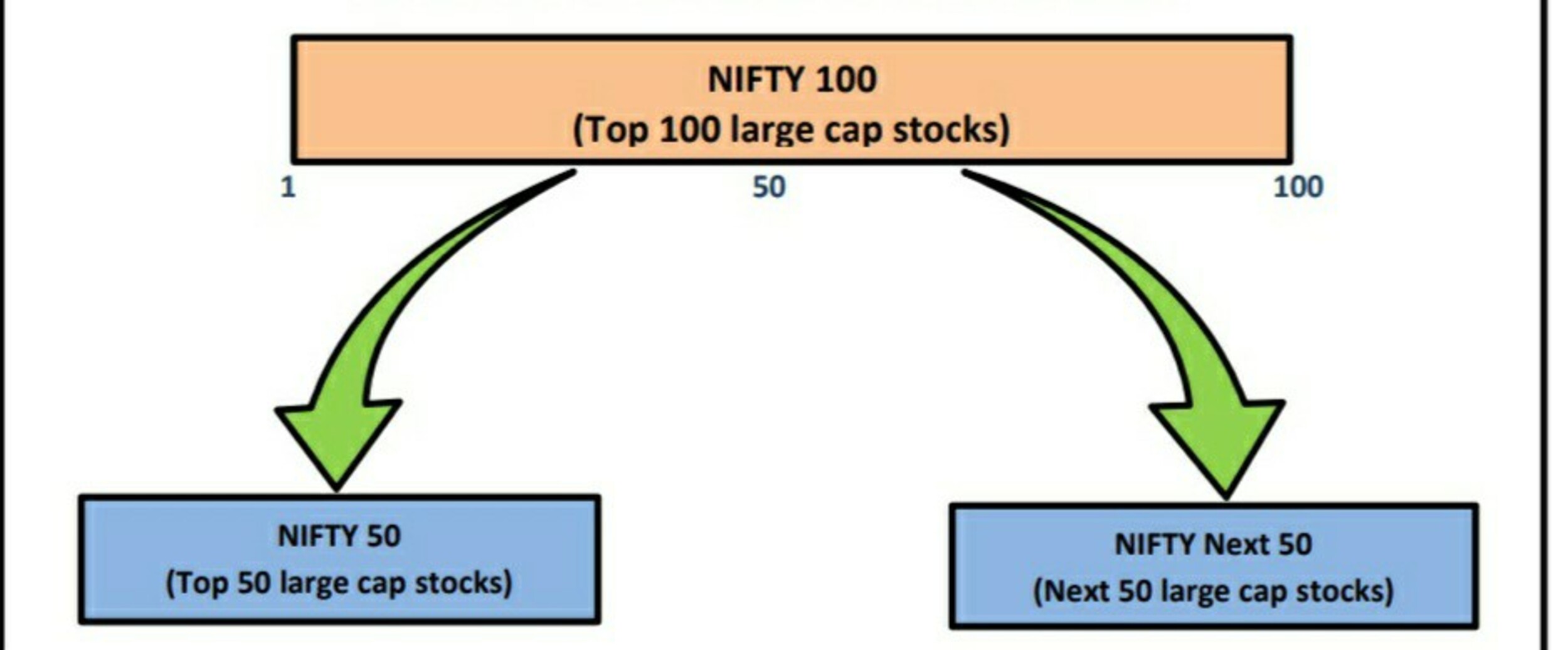

The NIFTY Next 50 Index represents 50 companies from NIFTY 100 after excluding the NIFTY 50 companies.

Nifty Next 50

Next 50 is computed using the free-float market capitalization method wherein the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value.Next 50 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

Nifty Next 50 Index

- The index has a base date of November 03, 1996, and a base value of 1000

- The index aims to measure the performance of the next 50 large-cap companies which come after the top 50 companies on the basis of free-float market capitalization within NIFTY 100

- The selection of securities and weights are based on free-float market capitalization

- The Next 50 Index represents about 10% of the free-float market capitalization of the stocks listed on NSE as on December 31, 2018

- As on December 2018, six months average daily turnover of all index constituents is approximately 13% of six months average daily turnover of all stocks listed on NSE

Stocks of NIFTY 50 and NIFTY Next 50 together form the part of the large-cap index –‘NIFTY 100’, where, subject to index criteria, the top 50 stocks based on the free-float market cap is represented by NIFTY 50 stocks and ‘next 50’ stocks is represented by NIFTY Next 50 stocks.

| S.No | Stock | weight % | Sector | Symbol |

| 1 | Avenue Supermarts Ltd | 5.4 | Consumer Discretionary | DMART |

| 2 | Muthoot Finance Ltd | 4.0 | Financials | MUTHOOTFIN |

| 3 | Apollo Hospitals Enterprise Ltd | 3.9 | Health Care | APOLLOHOSP |

| 4 | Adani Transmission Ltd | 3.6 | Utilities | ADANITRANS |

| 5 | Adani Enterprises Ltd | 3.2 | Industrials | ADANIENT |

| 6 | Vedanta Ltd | 3.0 | Materials | VEDL |

| 7 | Info Edge (India) Ltd | 3.0 | Communication Services | NAUKRI |

| 8 | Pidilite Industries Ltd | 3.0 | Materials | PIDILITIND |

| 9 | Adani Green Energy Ltd | 2.7 | Utilities | ADANIGREEN |

| 10 | Godrej Consumer Products Ltd | 2.7 | Consumer Staples | GODREJCP |

| 11 | ICICI Lombard General Insurance Company Ltd | 2.6 | Financials | ICICIGI |

| 12 | Piramal Enterprises Ltd | 2.6 | Financials | PEL |

| 13 | Dabur India Ltd | 2.6 | Consumer Staples | DABUR |

| 14 | Larsen & Toubro Infotech Ltd | 2.5 | Information Technology | LTI |

| 15 | Havells India Ltd | 2.4 | Industrials | HAVELLS |

| 16 | Jubilant Foodworks Ltd | 2.2 | Consumer Discretionary | JUBLFOOD |

| 17 | Ambuja Cements Ltd | 2.1 | Materials | AMBUJACEM |

| 18 | United Spirits Ltd | 2.1 | Consumer Staples | MCDOWELL-N |

| 19 | Marico Ltd | 2.1 | Consumer Staples | MARICO |

| 20 | PI Industries Ltd | 1.9 | Materials | PIIND |

| 21 | GAIL (India) Ltd | 1.9 | Utilities | GAIL |

| 22 | HDFC Asset Management Company Ltd | 1.9 | Financials | HDFCAMC |

| 23 | SBI Cards and Payment Services Ltd | 1.9 | Financials | SBICARD |

| 24 | DLF Ltd | 1.9 | Real Estate | DLF |

| 25 | Siemens Ltd | 1.8 | Industrials | SIEMENS |

| 26 | Bandhan Bank Ltd | 1.7 | Financials | BANDHANBNK |

| 27 | Lupin Ltd | 1.7 | Health Care | LUPIN |

| 28 | ICICI Prudential Life Insurance Company Ltd | 1.7 | Financials | ICICIPRULI |

| 29 | Cholamandalam Investment and Finance Company Ltd | 1.7 | Financials | CHOLAFIN |

| 30 | Gland Pharma Ltd | 1.6 | Health Care | GLAND |

| 31 | Aurobindo Pharma Ltd | 1.6 | Health Care | AUROPHARMA |

| 32 | Colgate-Palmolive (India) Ltd | 1.6 | Consumer Staples | COLPAL |

| 33 | Hindustan Petroleum Corp Ltd | 1.5 | Energy | HINDPETRO |

| 34 | ACC Ltd | 1.5 | Materials | ACC |

| 35 | Yes Bank Ltd | 1.5 | Financials | YESBANK |

| 36 | Indraprastha Gas Ltd | 1.4 | Utilities | IGL |

| 37 | Interglobe Aviation Ltd | 1.4 | Industrials | INDIGO |

| 38 | Indus Towers Ltd | 1.4 | Communication Services | INDUSTOWER |

| 39 | Bajaj Holdings and Investment Ltd | 1.3 | Financials | BAJAJHLDNG |

| 40 | Steel Authority of India Ltd | 1.3 | Materials | SAIL |

| 41 | NMDC Ltd | 1.3 | Materials | NMDC |

| 42 | Biocon Ltd | 1.2 | Health Care | BIOCON |

| 43 | Torrent Pharmaceuticals Ltd | 1.2 | Health Care | TORNTPHARM |

| 44 | Berger Paints India Ltd | 1.2 | Materials | BERGEPAINT |

| 45 | Bosch Ltd | 1.1 | Consumer Discretionary | BOSCHLTD |

| 46 | Procter & Gamble Hygiene and Health Care Ltd | 1.1 | Consumer Staples | PGHH |

| 47 | Bank of Baroda Ltd | 1.1 | Financials | BANKBARODA |

| 48 | Cadila Healthcare Ltd | 1.0 | Health Care | CADILAHC |

| 49 | Punjab National Bank | 0.9 | Financials | PNB |

| 50 | Jindal Steel And Power Ltd | 0.2 | Materials | JINDALSTEL |

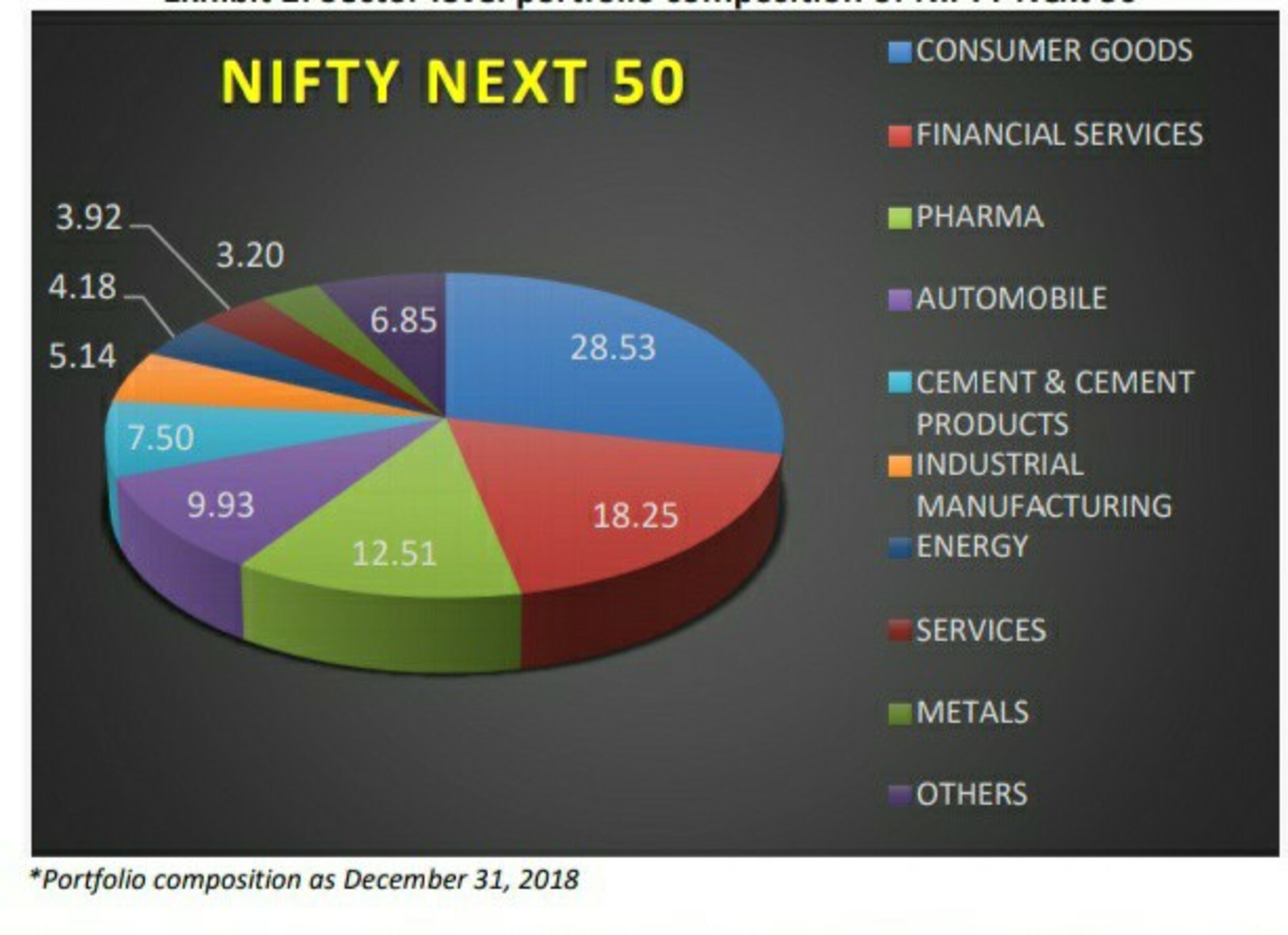

Nifty Next 50 Sector Weightage

NIFTY Next 50 has a well-diversified portfolio across sectors with the top 5 sectors accounting for 76% exposure. The index in all has exposure to 14 sectors with 11 sectors having individual weight lesser than 10% each. This makes NIFTY Next 50 a well-diversified index strategy which may appeal to proponents of ‘investment diversification’.

Sector Representation Sector Weight

Here is the List of sector with Weightage in Nifty Next 50 Index

- FINANCIAL SERVICES 29.13 % Sector Weightage

- CONSUMER GOODS 24.93 % Sector Weightage

- PHARMA 11.67 % Sector Weightage

- CEMENT & CEMENT PRODUCTS 6.90 % Sector Weightage

- ENERGY 6.74 % Sector Weightage

- AUTOMOBILE 5.12 % Sector Weightage

- SERVICES 3.97 % Sector Weightage

- CHEMICALS 2.81 % Sector Weightage

- METALS 1.98 % Sector Weightage

- TEXTILES 1.97 % Sector Weightage

- INDUSTRIAL MANUFACTURING 1.94 % Sector Weightage

- CONSTRUCTION 1.49 % Sector Weightage

- IT 0.96 % Sector Weightage

- TELECOM 0.38 % Sector Weightage

Top constituents by weightage

Here is the List of Stocks with weightage in Nifty Next 50 Index

| S.No | Stock | weight % |

| 1 | Avenue Supermarts Ltd | 5.4 |

| 2 | Muthoot Finance Ltd | 4.0 |

| 3 | Apollo Hospitals Enterprise Ltd | 3.9 |

| 4 | Adani Transmission Ltd | 3.6 |

| 5 | Adani Enterprises Ltd | 3.2 |

| 6 | Vedanta Ltd | 3.0 |

| 7 | Info Edge (India) Ltd | 3.0 |

| 8 | Pidilite Industries Ltd | 3.0 |

| 9 | Adani Green Energy Ltd | 2.7 |

| 10 | Godrej Consumer Products Ltd | 2.7 |

| 11 | ICICI Lombard General Insurance Company Ltd | 2.6 |

| 12 | Piramal Enterprises Ltd | 2.6 |

| 13 | Dabur India Ltd | 2.6 |

| 14 | Larsen & Toubro Infotech Ltd | 2.5 |

| 15 | Havells India Ltd | 2.4 |

NIFTY Next 50 has low weight concentration among individual stocks resulting in a highly diversified portfolio. On a stock level basis, NIFTY Next 50 boasts of a diversified and well-distributed portfolio with top 10 stocks contributing close to 35.4% exposure with individual stock weights ranging between 5.47% to 2.85%

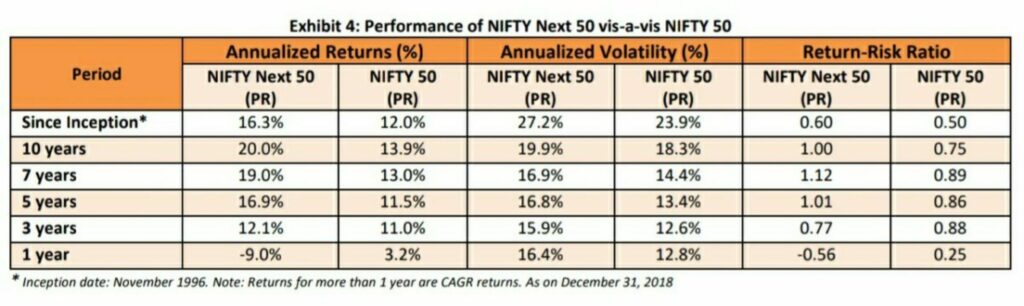

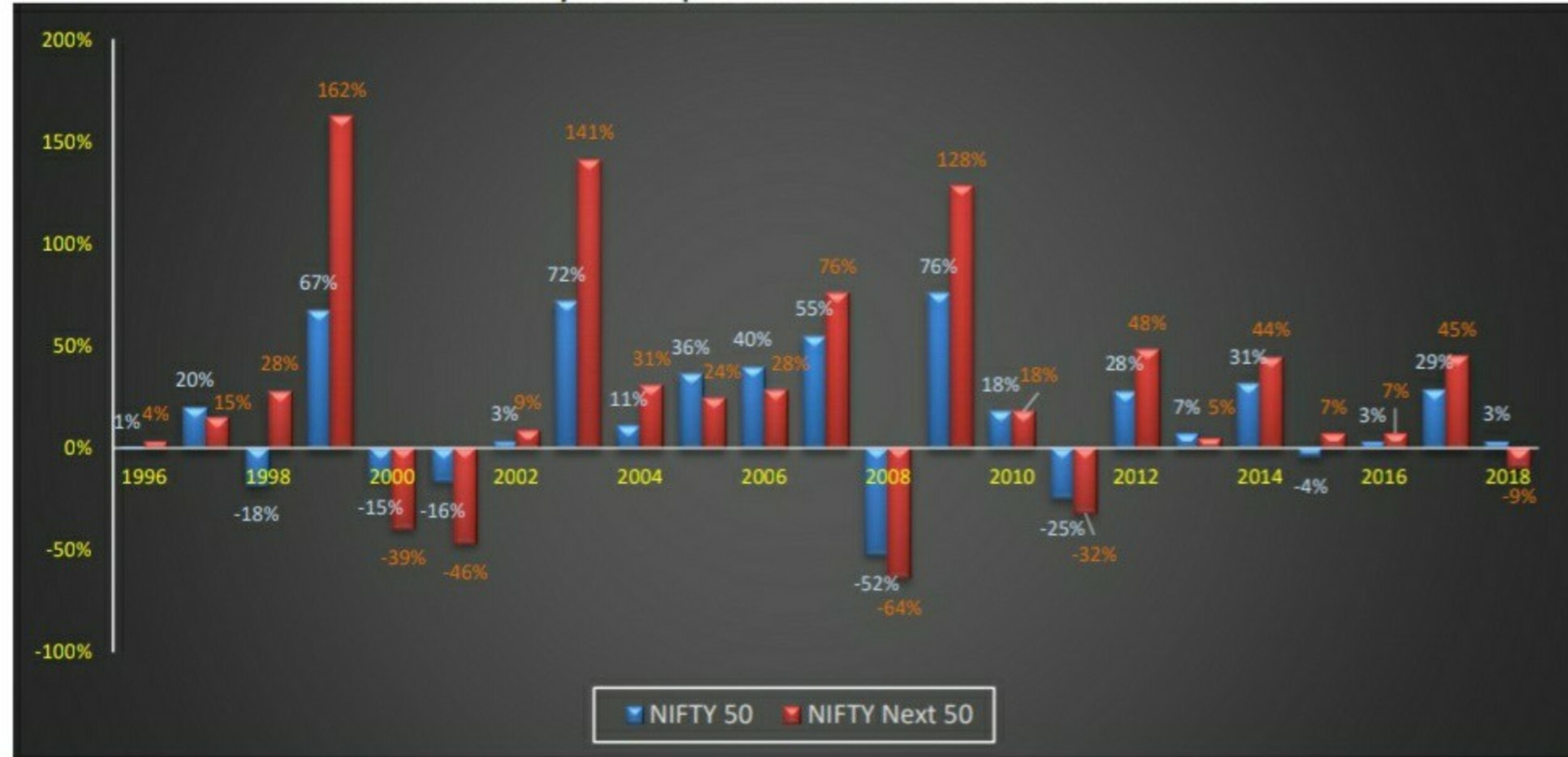

Since its inception in November 1996, the NIFTY Next 50 index has delivered an annualized return (PR) of 16.3% as compared to 12.0% of NIFTY 50, a substantial excess return of 4.3% per annum. The outperformance of NIFTY Next 50 for period 10 year, 7 year and 5 year is even better at 6.1%, 6%, 5.4% respectively.

While the returns of NIFTY Next 50 have been impressive, the risk (read standard deviation) has been only marginally higher as compared to that of NIFTY 50 making the ‘return to risk’ ratio for the NIFTY Next 50 considerably better than that of the NIFTY 50 – at least for periods longer than 3 year.

NIFTY Next 50 has outperformed the NIFTY 50 in 13 out of 23 calendar years. Calendar years 1999, 2003, 2009, 2012 & 2017 specifically witnessed great outperformance by NIFTY Next 50.

Here is the List of Stocks based on weightage in Nifty Next 50 Index. SBI Life Insurance Company Ltd, HDFC Life Insurance Company Ltd, Godrej Consumer Products Ltd, Dabur India Ltd.

The NIFTY Next 50 Index represents 50 companies [Mostly Large cap Companies] from NIFTY 100 after excluding the NIFTY 50 companies.